Get Crs Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Crs Form online

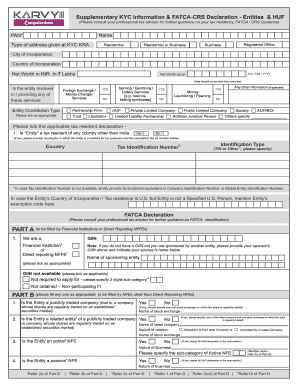

The Crs Form is an essential document for entities seeking to declare their tax residency and related financial information. This guide provides a clear and supportive walkthrough on how to fill out the form online, ensuring accuracy and compliance.

Follow the steps to complete the Crs Form effectively.

- Click the ‘Get Form’ button to obtain the Crs Form and open it for editing.

- Provide the name of the entity along with the Permanent Account Number (PAN) in the designated fields. Ensure that all information is accurate to avoid delays.

- Indicate the type of address as specified in your KYC documentation. Choose from residential, registered office, or business by marking the appropriate option.

- Fill in the city and country of incorporation appropriately, making sure to select the correct jurisdiction.

- Enter the net worth in Indian Rupees as of the specified date. Be sure that this date is not older than one year from the current filing date.

- Respond to the inquiry regarding the entity's involvement in certain services by ticking 'Yes' or 'No'. Provide additional information if applicable.

- Complete the tax resident declaration by selecting whether the entity is a tax resident of a country other than India. If so, provide the relevant countries and tax identification numbers.

- Fill out the FATCA declaration part as per your entity's classification, whether it's a financial institution or a non-financial entity.

- Detail the beneficial ownership information, including all controlling persons and their respective tax residency details.

- Review the entire form for accuracy before submission. You can save changes, download the document, print, or share it as necessary.

Begin completing the Crs Form online to ensure your financial compliance today.

The purpose of the CRS form is to deliver essential information in a straightforward manner that investors can easily understand. It aims to facilitate transparency in financial relationships, allowing clients to grasp the services and fees they may encounter. By utilizing the CRS form, you can engage in better conversations with your financial advisor about your investment strategy. This tool ultimately fosters informed decision-making.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.