Get Qualify To Claim Exemption From Tax In The State That Would Otherwise Be Due Tax On This Sale

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qualify To Claim Exemption From Tax In The State That Would Otherwise Be Due Tax On This Sale online

This guide provides comprehensive instructions on filling out the Qualify To Claim Exemption From Tax In The State That Would Otherwise Be Due Tax On This Sale form online. Whether you are new to digital document management or require a refresher, this step-by-step approach will help you complete the form accurately and efficiently.

Follow the steps to successfully complete your exemption certificate online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing tool.

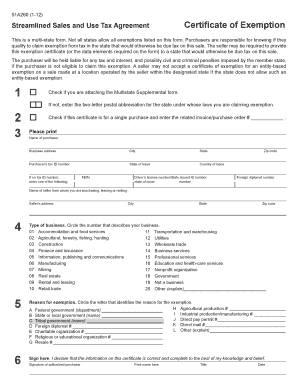

- When you have the form open, determine if you are attaching the Multistate Supplemental form. If not, enter the two-letter postal abbreviation of the state from which you are claiming the exemption.

- Indicate whether this certificate is for a single purchase. If applicable, enter the related invoice or purchase order number in the designated field.

- In the section for the name of the purchaser, clearly print your name, business address, city, state, zip code, and tax ID number if applicable. If you do not have a tax ID number, fill in either your FEIN or driver's license number/state-issued ID number.

- Enter the name and address of the seller from whom you are purchasing, leasing, or renting, including their city, state, and zip code.

- Circle the number that represents the type of business you operate from the provided list.

- Circle the letter corresponding to the reason for the exemption, ensuring you provide any additional information requested.

- Finally, sign the form in the designated area, print your name, state your title, and date the form.

- Once all the fields have been completed, review your information for accuracy. You can then save your changes, download, print, or share the completed form as needed.

Start filling out your exemption certificate online today to ensure timely processing.

To qualify to claim exempt on your taxes, you must meet specific criteria set by the IRS or your state's tax authority. This could include income levels, filing status, or specific reason codes for exemption. It's important to review the guidelines based on your unique situation. By ensuring compliance with these requirements, you can effectively qualify to claim exemption from tax in the state that would otherwise be due tax on this sale.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.