Loading

Get Personal Loan Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Personal Loan Form online

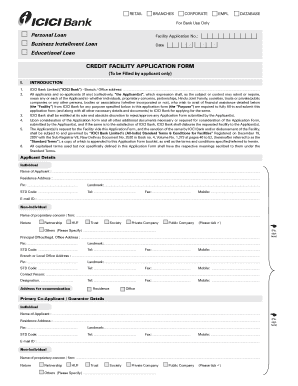

Filling out a personal loan form online is an essential step toward securing financial assistance for your needs. This guide provides a clear and supportive approach to completing the Personal Loan Form, ensuring that users can navigate each section with confidence.

Follow the steps to successfully complete your Personal Loan Form.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with the section labeled 'Applicant Details.' Depending on whether you are an individual or a non-individual entity, make sure to fill in the appropriate name and address details accurately. Include your pin code, and provide contact information like phone numbers and email addresses.

- Next, you will find fields for 'Primary Co-Applicant / Guarantor Details.' If applicable, fill in their information in the same format as your details.

- Proceed to ‘Facility Details & Other Charges.’ Specify the type of loan you are applying for and the amount you seek. Clearly indicate the purpose of the loan and understand any related charges, including processing fees and origination charges.

- In the ‘Repayment’ section, indicate the amount of each installment, the due dates, and the number of installments. Choose your preferred mode of payment from the options provided.

- Review the 'Declarations by the Applicant(s)' section carefully. Confirm that all entered information is accurate, complete, and reflects your true financial situation.

- Complete the signature section, ensuring all applicants and co-applicants sign the form where required.

- After filling in all sections, save your changes. You may download or print the form directly from the online editor. Ensure you share or submit according to your financial institution's requirements.

Start filling out your Personal Loan Form online today to take the first step toward obtaining your financial assistance.

How To Write A Loan Request Letter Your name. Your address. Your business name. Your business address. Name of loan agent or lender. Contact information of lender or loan agent. Subject line with the requested loan amount.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.