Loading

Get Krs Form 2035

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Krs Form 2035 online

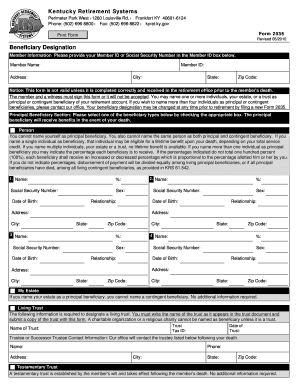

Filling out the Krs Form 2035 is an important step in managing your beneficiary designations for retirement benefits. This guide provides clear instructions for completing this form online, ensuring that you provide the necessary information accurately and efficiently.

Follow the steps to complete your Krs Form 2035 online

- Click the ‘Get Form’ button to access the Krs Form 2035 in your preferred format.

- Enter your member information, including your Member ID or Social Security Number, name, address, and contact details in the designated fields.

- In the principal beneficiary section, select the appropriate beneficiary type by checking the corresponding box. You may choose one or more individuals, your estate, or a living trust. Note that you cannot name yourself as a beneficiary.

- If you select individual beneficiaries, provide their names, Social Security Numbers, dates of birth, relationships to you, and addresses. If naming multiple individuals, indicate the percentage each will receive, ensuring the total is 100%.

- If you choose to designate a living trust, enter the trust's name as it appears in the trust document, along with the Trust Tax ID and date. A copy of the trust document must be submitted with the form.

- Complete the contingent beneficiary section by selecting the appropriate beneficiary type, following the same steps as for the principal beneficiaries.

- Review your entries for accuracy, sign the form, and ensure it is witnessed as required for validation. Only one beneficiary type may be checked in each section.

- Once you have filled out all necessary information, you can save changes to the form, download it, print it for your records, or share it as needed.

Begin filling out your Krs Form 2035 online today to ensure your beneficiary designations are up-to-date.

A death benefit is a payout to the beneficiary of a life insurance policy, annuity, or pension when the insured person or annuitant dies. With life insurance policies, death benefits are not usually subject to income tax and named beneficiaries typically receive the death benefit as a lump-sum payment.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.