Get Authority To Deduct Form Pag Ibig 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Authority To Deduct Form Pag Ibig online

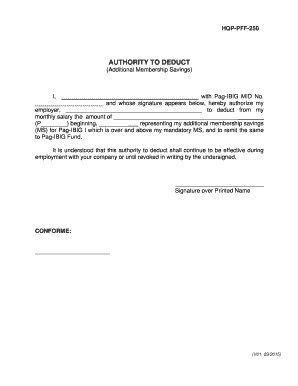

Filling out the Authority To Deduct Form Pag Ibig online is an essential process for individuals looking to authorize their employers to deduct additional membership savings from their monthly salaries. This guide will provide clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to complete your Authority To Deduct Form Pag Ibig online.

- Click the ‘Get Form’ button to obtain the Authority To Deduct Form Pag Ibig and open it in your preferred editor.

- In the designated area, enter your full name as it appears on official documents. Be sure to use proper formatting.

- Input your Pag-IBIG Membership Identification (MID) number in the specified field. This number is crucial for tracking your savings.

- Next, provide your employer's name where indicated. Ensure that the spelling and title of the employer are accurate.

- In the following section, specify the amount you wish to authorize your employer to deduct from your monthly salary. Write the amount in both numbers and words for clarity.

- Indicate the starting date for these deductions. Be clear and use the appropriate date format.

- Read through the terms mentioned in the form. Ensure you understand that this authorization remains effective until canceled in writing.

- Finally, ensure your signature is affixed above your printed name in the designated space to validate the form.

- Once you complete all sections accurately, you can save changes to your work, download the completed form, print it, or share it as needed.

Complete your Authority To Deduct Form Pag Ibig online today to streamline your additional membership savings setup!

The deductions for Pag-IBIG typically range from 2% to 3% of your monthly salary, depending on your income bracket. Employers match this contribution, creating a structured savings and investment plan for employees. Understanding the specifics of the Authority To Deduct Form Pag Ibig can help ensure that you accurately track these deductions and manage your finances effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.