Get Form Spain Individual 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Spain Individual online

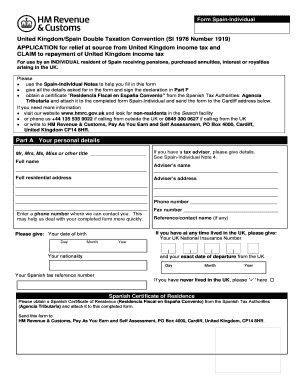

Filling out the Form Spain Individual is essential for individuals residing in Spain who are looking to claim relief from UK income tax under the double taxation treaty. This guide will provide clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to fill out the Form Spain Individual online effectively.

- Press the ‘Get Form’ button to access and open the Form Spain Individual in your editor.

- Part A requires your personal details. Fill in your full name, residential address, and contact number. If you have a tax adviser, provide their details as well.

- In Part B.1, respond to the questions regarding your tax residency, history of residing in the UK, and any properties owned in the UK. Make sure to indicate if you have never lived in the UK.

- Provide additional information in Part B.2 if required, including any details on your tax status or property ownership.

- In Part C, select the appropriate sections (C.1, C.2, C.3, or C.4) based on the sources of income you are claiming relief for. Ensure to provide all necessary details for pensions, interest, and royalties.

- For Part D, list any UK income tax that has already been deducted from payments you've received. This includes specifying the sources and amounts.

- If you would like the repayment made to someone else, complete Part E with the nominee's details.

- Finally, sign and date the declaration in Part F to confirm that the information provided is true and accurate.

- Once you have filled out the form, save your changes, and prepare to download, print, or share the completed form as needed.

Complete your Form Spain Individual online today to ensure your tax relief claims are processed accurately.

To submit Form 030 in Spain, individuals must typically send it to the local tax office, either in person or electronically. Ensure all personal information is accurate to avoid delays in processing. Submitting this form promptly helps establish your tax obligations correctly. Using Form Spain Individual can simplify the task of submission, ensuring you meet all requirements efficiently.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.