Loading

Get Form F 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form F online

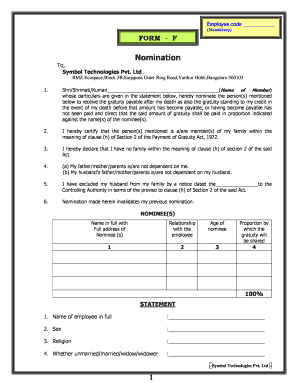

Filling out Form F is an important process for nominating individuals to receive gratuity benefits. This guide will walk you through each section and field of the form to ensure you complete it accurately and effectively.

Follow the steps to properly complete Form F online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- In the first section, fill out your full name where indicated (Name of Member). Ensure that this matches the name on official documents.

- Complete the nominee section by providing the full names, addresses, relationships, ages, and proportion of gratuity share for each nominee listed.

- In section two, certify that the nominated person(s) are family members as defined by the relevant legislation, or declare that you have no family.

- State whether your parents are dependent on you, or if your partner’s parents are dependent on them, as applicable.

- Mention any previous exclusions regarding your partner in the specified clause if applicable.

- Indicate that this nomination supersedes any prior nominations you have made.

- Fill out the Employee Statement section, including your full name, sex, religion, marital status, department, post held, date of appointment, and permanent address.

- Sign or provide a thumb impression in the designated area and include the place and date of signing.

- Complete the declaration by witnesses section, including their names, addresses, and signatures.

- Have the employer or an authorized officer certify the nomination by signing and providing the necessary details, including date and designation.

- Finally, receive and acknowledge your duplicate copy of the nomination form, ensuring your signature is on the receipt.

- After verifying that all fields are accurately completed, you can save your changes, download the form for your records, print it, or share it as needed.

Complete your Form F online today to ensure your gratuity nominations are accurately submitted.

Related links form

Filing an income tax return form involves gathering your financial records, including income statements and deductions. You can choose the appropriate form based on your tax situation, such as Form F for foreign income. Fill it out carefully, and make sure to check for any errors before filing. For those looking for a straightforward filing process, US Legal Forms offers user-friendly options to assist you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.