Loading

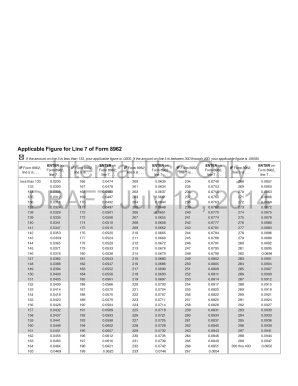

Get Applicable Figure Table 2019 2020-2026

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Applicable Figure Table 2019 online

Filling out the Applicable Figure Table 2019 online can seem daunting, but this guide aims to simplify the process. Whether you are familiar with digital documents or new to them, the instructions here will help you navigate the form with confidence.

Follow the steps to complete the Applicable Figure Table 2019 correctly.

- Click the ‘Get Form’ button to access the Applicable Figure Table 2019 and open it in the editor.

- Begin with section one of the form, where you will input basic information such as your name and identification number. Ensure that all data is entered accurately to avoid processing delays.

- Proceed to section two, which may require you to enter specific figures related to your health plan. Double-check these figures against your policy documents for accuracy.

- In section three, you might be asked to provide additional details regarding your coverage options. Take your time to read through the guidelines to ensure you understand what is being requested.

- If there are any optional sections, consider whether the information is relevant to your situation. Providing accurate and comprehensive information can facilitate smoother processing.

- Once you have completed all necessary sections, review the entire form for any errors or omissions. This step is crucial for ensuring that all your information is correct.

- After reviewing, you can save your changes, download the form, print it for your records, or share it as needed.

Start completing your documents online for a streamlined experience.

You are asked to fill out form 8962 to reconcile your premium tax credit, which is crucial for ensuring you received the correct amount based on the Applicable Figure Table 2019. This form helps verify your eligibility and the accuracy of your tax credits. Failing to complete it may delay your refund or impact your tax obligations. If you need help, USLegalForms offers support to navigate this process efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.