Loading

Get Conventional Loan Contingency Exhibit 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Conventional Loan Contingency Exhibit online

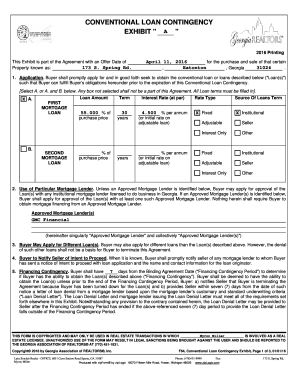

The Conventional Loan Contingency Exhibit is an essential document in real estate transactions that outlines the buyer's intention to secure a conventional loan. This guide will provide you with step-by-step instructions for completing the form online, ensuring a smooth and accurate submission process.

Follow the steps to fill out the Conventional Loan Contingency Exhibit with confidence.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the loan amount for the first mortgage loan by specifying the percentage of the purchase price. If applicable, also fill in the amount for the second mortgage loan.

- Specify the loan term for both mortgage loans, indicating the number of years you intend for each.

- Select the interest rate type by indicating whether the interest rate is fixed or adjustable for both loans.

- Identify the source of the loans by selecting either 'Institutional' or 'Seller' as appropriate.

- If you have an approved mortgage lender, enter their details in the designated space. If you do not have one, you may apply with any licensed institutional lender in Georgia.

- In the next section, acknowledge your ability to apply for different loans than those listed, if desired.

- Notify the seller promptly if you intend to proceed with a specific loan application.

- Understand the financing contingency by noting that you have seven days to determine your ability to obtain the loans.

- Complete any additional requirements as needed, including the submission of a loan denial letter if applicable.

- Finally, review all entries for accuracy, then save changes, download, print, or share the completed form as needed.

Complete your Conventional Loan Contingency Exhibit online today to streamline your real estate transaction.

A contingency timeline outlines the critical deadlines within a real estate contract, particularly regarding financing. It defines when the buyer must secure financing, make necessary disclosures, and notify the seller of any issues. Understanding this timeline helps prevent misunderstandings and supports a smoother transaction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.