Loading

Get Gst101 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst101 online

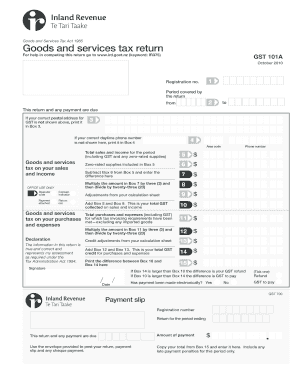

The Gst101 form is an essential document for reporting goods and services tax in your business. This guide provides clear and comprehensive instructions on how to complete the form online, ensuring you can accurately report your tax obligations.

Follow the steps to successfully complete your Gst101 form.

- Click ‘Get Form’ button to access the Gst101 form and open it in your preferred online editor.

- Enter your registration number in the appropriate field at the top of the form to ensure it is associated with your account.

- Fill in the period covered by the return, indicating the start and end dates in the designated fields.

- If your current postal address for GST is not displayed, please print the correct address in Box 3.

- Provide your correct daytime phone number in Box 4, including the area code, if it is not already filled in.

- Report your total sales and income for the period in Box 5, ensuring to include GST and any zero-rated supplies.

- List any zero-rated supplies included in Box 5 in Box 6.

- Subtract the total from Box 6 from Box 5 and enter that amount in Box 7.

- Multiply the amount in Box 7 by three, then divide that total by twenty-three, and write the result in Box 8.

- Include any adjustments from your calculation sheet in Box 9.

- Add the totals from Box 8 and Box 9. This gives you your total GST collected from sales and income, which you should enter in Box 10.

- Report total purchases and expenses (including GST) that meet tax invoicing requirements, excluding any imported goods, in Box 11.

- Multiply the amount in Box 11 by three and divide by twenty-three, writing that number in Box 12.

- Record any credit adjustments from your calculation sheet in Box 13.

- Combine the totals from Box 12 and Box 13 to determine your total GST credit for purchases and expenses, and enter this total in Box 14.

- Calculate the difference between Box 10 and Box 14. Record this amount in Box 15.

- Indicate whether payment has been made electronically by ticking the appropriate box.

- If applicable, copy your total from Box 15 and enter it on the payment slip.

- Use the provided envelope to post your completed return, payment slip, and any cheque payment, if necessary.

- Finally, review all entries for accuracy before submitting.

Complete your Gst101 form online today to ensure timely and accurate reporting of your tax obligations.

The format for reporting gross total income should include a summary of all income sources, clearly itemized by type. This typically involves sections for wages, business income, and additional earnings. When following Gst101, you’ll find a structured approach to compiling these figures effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.