Loading

Get Fin 319

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fin 319 online

Filling out the Fin 319 form is essential for claiming an exemption from provincial sales tax on a vehicle received as a gift. This guide will provide you with clear, step-by-step instructions to navigate the form confidently.

Follow the steps to complete the Fin 319 form online.

- Click the ‘Get Form’ button to access the Fin 319 form and open it in your preferred editor. This allows you to begin filling out the necessary information.

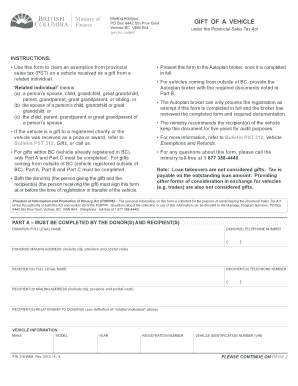

- In Part A, provide the full legal name and mailing address of both the donor and recipient. Ensure that the telephone numbers are also included for both parties.

- Detail the recipient's relationship to the donor, selecting from the specified categories. This is crucial for qualifying as a gift from a related individual.

- In the vehicle information section, enter the make, model, year, registration number, and vehicle identification number (VIN) of the vehicle being gifted.

- If the vehicle is coming from outside of British Columbia, complete Part B by checking the appropriate sections based on the donor's previous tax payments or exemptions.

- In Part C, both the donor and the recipient must sign to certify that the vehicle is a gift, confirming that no consideration has been exchanged.

- Once the form is fully completed, review all entries for accuracy. You can then save changes, download, print, or share the form as needed.

Complete your Fin 319 form online today to ensure a smooth processing of your vehicle gift exemption.

You can indeed give a friend 1 million dollars, but be aware of the tax ramifications. Gifts over the annual exclusion limit may necessitate a gift tax return filing. It’s important to stay informed on regulations surrounding large gifts to avoid complications. Using US Legal Forms can simplify the process and ensure that you adhere to financial regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.