Loading

Get Form Itr 4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form ITR-4 online

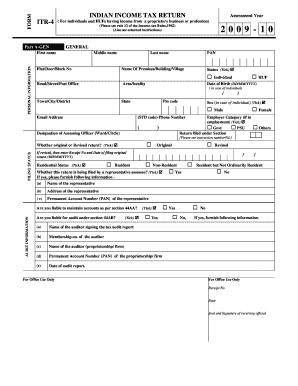

Filling out the Form ITR-4 online can seem daunting, but this guide will provide you with clear, step-by-step instructions to ease the process. This form is specifically designed for individuals and Hindu Undivided Families (HUFs) with income from a proprietary business or profession.

Follow the steps to fill out Form ITR-4 effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- Complete Part A-GEN, which includes entering your personal information, such as first name, middle name, last name, and PAN. Indicate your status (Individual or HUF) and fill in your date of birth, residential address, and contact number.

- Fill out the Filing Status section by indicating whether the return is original or revised and select your residential status (Resident, Non-Resident, etc.).

- In Part A-BS, provide details for your balance sheet as of March 31, 2009. This includes sources and applications of funds.

- Proceed to Part A-P&L to disclose your profit and loss account for the financial year 2008-09. Fill in all required fields accurately.

- Complete Part A-OI with any additional optional information, only if applicable.

- Enter quantitative details in Part A-QD if you are liable for audit. Fill this section only if required and applicable.

- Move to Part B for the Computation of Total Income. Summarize your income per the various heads based on the details you provided in previous sections.

- Follow the instructions in Part B-TTI to calculate your tax liability on the total income, adding any applicable deductions.

- After completing all sections, review your information for accuracy. Save changes, and choose to download, print, or share the completed form.

Complete your Form ITR-4 online now for accurate filing!

Yes, you can file Form ITR 4 after the due date, although there may be penalties involved. The Income Tax Department allows you to submit your return within a specified period beyond the original deadline. It's beneficial to file as soon as possible to minimize any penalties and comply with tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.