Loading

Get 2181 Trust 2 Form 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2181 Trust 2 Form online

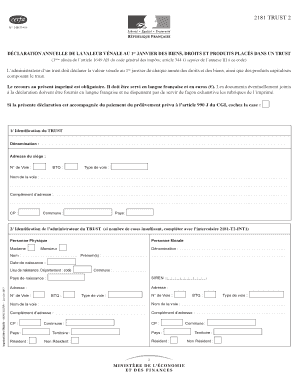

The 2181 Trust 2 Form is a crucial document that enables the administrator of a trust to declare the market value of assets held in the trust as of January 1st each year. This guide provides clear and concise instructions on how to fill out this form online, ensuring compliance with legal requirements.

Follow the steps to successfully complete the 2181 Trust 2 Form online.

- Use the 'Get Form' button to obtain the 2181 Trust 2 Form and open it in your browser. This will allow you to access the form in an editable format.

- Start with Section 1, 'Identification of the Trust.' Provide the trust's name and its registered address. Ensure to enter the street number and the type of street (like 'Avenue' or 'Boulevard') clearly.

- In Section 2, 'Identification of the Administrator of the Trust,' indicate whether the administrator is an individual or an organization. Fill in their name, date of birth, and contact address, ensuring accuracy for all fields.

- Proceed to Section 3, where you need to identify the constituents or beneficiaries stated in the trust. For each individual mentioned, check the appropriate boxes and provide their personal details, including date and place of birth.

- Section 4 requires listing the beneficiaries of the trust. Similar to Section 3, provide necessary personal information for each beneficiary, ensuring to indicate their status as a resident or non-resident.

- In Section 5, provide detailed descriptions of the trust’s terms as required by the legal framework. This might include regulations or any relevant rules applicable to the trust management.

- Section 6 involves preparing an inventory of the assets within the trust. Whether it's real estate or liquid assets, record each asset's description, cadastral reference, and market value as of January 1st in the specified fields.

- Finally, ensure you review, save your changes, and if necessary, download, print, or share the completed 2181 Trust 2 Form for submission.

Prepare and fill out your 2181 Trust 2 Form online today to ensure compliance and smooth management of your trust.

If you do not declare when required, or miss the deadline, you risk: Tax amount increases as follows: 10% if you have not received a formal mise en demeure warning letter; 20% if you have received a formal notice and you send in your return within 30 days of receiving this warning.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.