Get Form 13614 (rev. 9-2004). Tax Preparation Information Sheet - Grsource

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13614 (Rev. 9-2004). Tax Preparation Information Sheet - Grsource online

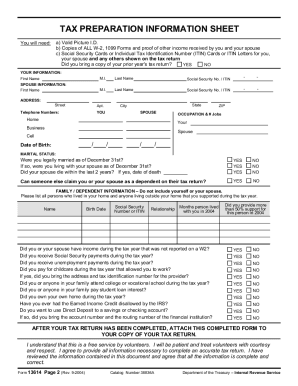

Filling out the Form 13614 (Rev. 9-2004), also known as the Tax Preparation Information Sheet, is a crucial step in preparing your tax return. This guide will provide you with comprehensive, step-by-step instructions to ensure all necessary information is accurately documented.

Follow the steps to complete the form correctly.

- Press the ‘Get Form’ button to access the document and open it in your preferred editor.

- Begin by providing taxpayer identification information. Enter the valid picture identification details for both you and your spouse. Fill in names, addresses, phone numbers, and Social Security Numbers (SSN) or Taxpayer Identification Numbers (TIN), ensuring you have the official documentation available.

- Indicate your marital status as of December 31st of the relevant tax year. Answer questions regarding your marital status, including whether you were single, married, or if your spouse passed away in the last two calendar years.

- List your dependents. Include all individuals who lived in your home during the tax year or who you supported while living outside your home. For each person, provide their name, birth date, Social Security Number or TIN, relationship to you, number of months they lived with you, and the support you provided.

- Document taxpayer income. State how many jobs you and your spouse had during the tax year. Confirm whether you brought W-2 forms or other proof of income. Also, indicate any other income sources not reported on a W-2, such as Social Security payments or Form 1099s.

- Report any taxpayer expenses. Outline any childcare expenses incurred that allowed you to work and provide the identification number of the provider if applicable. Mention if anyone in your household attended college or vocational school during the year.

- Fill in additional taxpayer information. Point out if you have ever had the Earned Income Tax Credit disallowed by the IRS. Confirm whether you wish to utilize Direct Deposit for your tax refund and provide your account number and routing number if applicable.

- Once all sections are completely filled out, remember to attach this completed form to your tax return for accurate processing.

Start filling out your Form 13614 online today to ensure a smooth tax preparation process!

Form 13614-NR is an essential document that serves as the intake and interview sheet for nonresident alien taxpayers. It collects specific information required to prepare nonresident tax returns accurately. Utilizing Form 13614 (Rev. 9-2004), Tax Preparation Information Sheet - Grsource, supports both tax professionals and clients in achieving accurate tax reporting and compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.