Loading

Get Ms Form 80 300

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ms Form 80 300 online

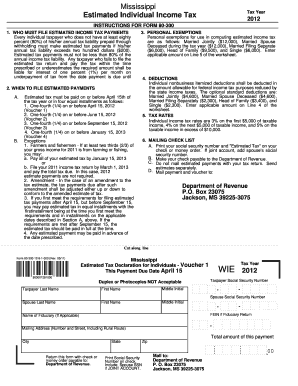

Filling out the Ms Form 80 300 for estimated income tax can be straightforward with clear guidance. This document serves as a comprehensive resource to assist you in accurately completing and submitting your form online.

Follow the steps to efficiently complete the Ms Form 80 300 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor. This allows you to begin filling out your estimated income tax declaration.

- Review the instructions carefully to understand the purpose of the form and the importance of estimated tax payments. Ensure you are aware of the requirements for filing, specifically regarding income thresholds and tax liabilities.

- Fill in your personal information accurately, including your name, social security number, and mailing address. If applicable, include your spouse's details as well.

- Enter your total expected income for the tax year as well as your spouse's if filing jointly. This will help determine your estimated taxable income.

- Complete the deductions section by selecting either itemized deductions or the standard deduction, referring to the corresponding instructions for the correct amounts.

- Calculate your personal exemptions based on your filing status, and record this information where indicated on the form.

- Subtract your total exemptions and deductions from your total income to find your estimated taxable income.

- Apply the relevant tax rates to calculate the tax owed on your estimated taxable income.

- Consider any income tax that is estimated to be withheld over the year and adjust your estimated tax accordingly.

- Once all entries are complete, review your inputs for accuracy, then save your changes, download, print, or share the form as needed before submission.

Begin completing the Ms Form 80 300 online today to ensure timely and accurate tax filing.

Yes, if you earn income in Mississippi, you typically must file a state income tax return. This applies whether you are a resident or a non-resident with Mississippi-source income. To ensure compliance and accuracy in your filing, utilizing resources such as MS Form 80 300 can make the process seamless.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.