Loading

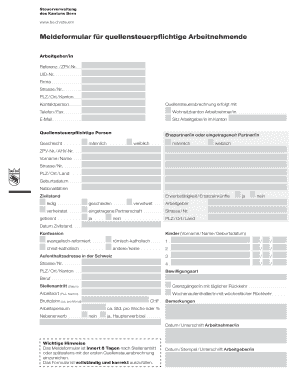

Get Meldeformular F R Quellenbesteuerte Arbeitnehmende. Meldeformular F R Quellenbesteuerte 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Meldeformular F R Quellenbesteuerte Arbeitnehmende online

This guide offers step-by-step instructions for filling out the Meldeformular F R Quellenbesteuerte Arbeitnehmende, designed for individuals who work under withholding tax regulations. Completing this form online ensures compliance and accuracy in reporting your employment details.

Follow the steps to fill out the Meldeformular F R Quellenbesteuerte efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the employer's information, including the reference number, UID number, name of the company, street address, postal code, city, and canton. Make sure all details are accurate.

- Provide the contact person’s information, including their phone number, fax number, and email address.

- Indicate the residency canton of the employee in the designated field.

- Next, enter the employee's personal information, including gender and details about their partner, if applicable. Fill in the ZPV/AHV number, first name, last name, address, postal code, country, date of birth, nationality, and employment status.

- Select the civil status of the employee from the provided options: single, divorced, married, registered partnership, separated, or widowed.

- List any children, including their first names, last names, and dates of birth, if applicable.

- Specify the religious denomination of the employee by selecting one from the provided list.

- Complete the employee's accommodation address in Switzerland, including the street number, postal code, city, and canton.

- Indicate the type of work permit and the job title, as well as the start date of employment.

- Provide the employee's gross monthly salary estimate.

- If applicable, indicate whether the employee has a secondary source of income and any relevant notes.

- Finally, sign and date the form, ensuring both the employee and employer have appropriate signatures.

Take a moment to complete your documents online for accurate and efficient submission.

Um ausländische Quellensteuer zurückzuholen, sollten Sie ebenfalls das Meldeformular F R Quellenbesteuerte nutzen. Es ist wichtig, das Formular korrekt auszufüllen, um Ihre legalen Ansprüche auf Rückzahlungen durchzusetzen. Weitere Hilfestellungen finden Sie auf Plattformen wie uslegalforms, die Sie durch den Prozess leiten können.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.