Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Tax Invoice Cum Acknowledgement Receipt Of Pan Application online

How to fill out and sign Tax Invoice Cum Acknowledgement Receipt Of Pan Application online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

The preparation of legal documents can be expensive and time-consuming. Nonetheless, with our ready-made web templates, everything becomes easier.

Presently, utilizing a Tax Invoice Cum Acknowledgement Receipt Of Pan Application takes no more than 5 minutes. Our state-of-the-art online samples and straightforward guidelines help eliminate human errors.

Utilize the fast search and robust cloud editor to create a precise Tax Invoice Cum Acknowledgement Receipt Of Pan Application. Eliminate the mundane and generate documents online!

- Choose the template from the catalog.

- Input all necessary information in the required fillable fields. The user-friendly drag-and-drop interface allows for easy addition or relocation of fields.

- Verify that everything is accurately filled out, with no errors or missing sections.

- Add your electronic signature to the document.

- Click Done to save the modifications.

- Save the document or print your PDF version.

- Share promptly with the recipient.

How to modify Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020: personalize forms online

Take advantage of the functionality of the feature-rich online editor while completing your Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020. Utilize the variety of tools to swiftly fill in the gaps and present the required information immediately.

Drafting documents is labor-intensive and costly unless you have pre-prepared fillable forms to complete them digitally. The best method to address the Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020 is to utilize our expert and multifunctional online editing solutions. We equip you with all the essential tools for prompt document completion and allow you to make any modifications to your templates, tailoring them to any requirements. Furthermore, you can comment on the alterations and leave notes for other stakeholders involved.

Here’s what you can accomplish with your Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020 in our editor:

Utilizing Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020 in our powerful online editor is the fastest and most efficient approach to supervise, submit, and share your documentation in the desired manner from any location. The tool functions from the cloud, allowing you to access it from anywhere using any internet-enabled device. All templates you generate or prepare are securely stored in the cloud, ensuring you can always reach them when necessary and guaranteeing you won’t lose them. Stop squandering time on manual document completion and eliminate paper; transition everything online with minimal effort.

- Complete the blank spaces using Text, Cross, Check, Initials, Date, and Sign tools.

- Emphasize crucial information with a preferred color or underline it.

- Conceal sensitive information with the Blackout tool or simply delete it.

- Insert images to illustrate your Get Tax Invoice Cum Acknowledgement Receipt Of Pan Application 2020.

- Replace the original text with content that meets your needs.

- Add comments or sticky notes to communicate with others about the modifications.

- Create additional fillable fields and designate them to specific recipients.

- Secure the template with watermarks, apply dates, and bates numbers.

- Distribute the documentation in various manners and store it on your device or cloud in different formats after you finish editing.

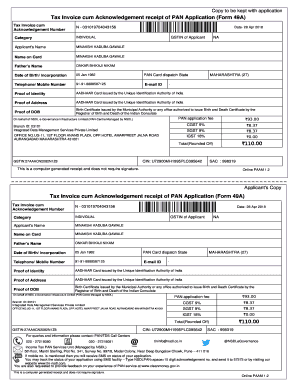

Form 49A is the application form for the allotment of Permanent Account Number for Indian residents. Any individual who is a resident of India and wishes to apply for PAN should compulsorily fill the form 49A as it is the application form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.