Get Texas Form 05 102 Instructions 2020 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Form 05 102 Instructions 2020 online

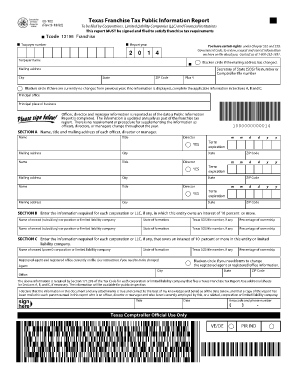

The Texas Form 05 102 is essential for corporations, limited liability companies, and financial institutions to fulfill their franchise tax obligations. This guide provides clear, step-by-step instructions for completing the form online, ensuring you meet all requirements effectively.

Follow the steps to fill out the Texas Form 05 102 Instructions 2020 online.

- Press the ‘Get Form’ button to access the Texas Form 05 102 for online completion.

- Enter the report year in the designated field. This indicates the tax period for which you are reporting.

- Provide your taxpayer number in the appropriate section. This number is unique to your entity and necessary for identification.

- Complete the taxpayer name section, ensuring it matches the legal name of your corporation or LLC.

- If your mailing address has changed, blacken the circle indicating this change, then fill out the new mailing address, including city, state, and ZIP code.

- Enter your Secretary of State (SOS) file number or Comptroller file number, ensuring accuracy.

- If there are no changes from the previous year, blacken the appropriate circle. If there are changes, input the required information in Sections A, B, and C.

- In Section A, list each officer, director, or manager's name, title, and mailing address, noting the term expiration date when applicable.

- Section B requires the names and information of any subsidiaries in which your entity owns a 10 percent interest or more. Fill out the necessary fields, including state of formation and ownership percentage.

- In Section C, provide details about any parent corporation or LLC that owns a 10 percent interest or more in your entity, including the registered agent and registered office information.

- Review all entered information for accuracy. Make any necessary edits before finalizing.

- After completing the form, save your changes, and you can opt to download, print, or share the form as needed.

Complete your Texas Form 05 102 online today to ensure compliance with franchise tax requirements.

To fill out the Texas public information report, begin by gathering your business's financial records, as this information is necessary. The Texas Form 05 102 Instructions 2020 can guide you through each section of the report, ensuring you include all required details. You can file this report electronically or by mail; just ensure you meet the deadlines. Consider using uslegalforms to simplify the process and access helpful templates.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.