Get Form 2159 (.pdf)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2159 (.pdf) online

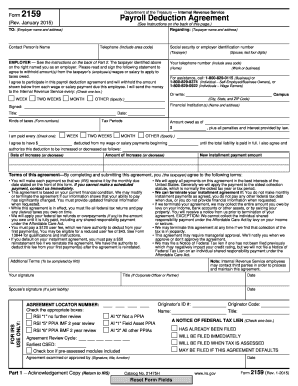

Filling out the Form 2159, also known as the Payroll Deduction Agreement, is an essential step for taxpayers looking to establish a payment plan with the IRS. This guide provides clear, step-by-step instructions to help users accurately complete the form online.

Follow the steps to successfully complete the Form 2159 online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred PDF editor.

- Begin by providing your taxpayer information, including your name, address, and Social Security number or employer identification number. Ensure all provided details reflect current information.

- Indicate your employer's name and address in the designated section. This information is critical for proper documentation and future correspondence.

- Enter the contact person's name and their phone number, including the area code. This will facilitate communication regarding your payroll deduction agreement.

- Select the frequency for payments you would like to set up: weekly, biweekly, or monthly. Mark the appropriate box.

- Specify the amount you wish to deduct from each wage or salary payment. This amount should reflect what you discussed with the IRS.

- Write down the date you want the deductions to begin. This is crucial for scheduling your payments correctly.

- List the financial institution's name and address for where the payments should be sent.

- Review all entered information for accuracy and ensure that all required fields are complete.

- Finally, save your changes. You can download the completed form, print it, or share it as needed. Ensure your employer signs the form before submission.

Complete your Form 2159 online today to maintain compliance with your tax obligations and streamline your payment process.

A 2159 is a specific form used for payroll deduction purposes, helping employers and employees navigate tax and benefit contributions. This form aids in documenting the deductions that will occur on a paycheck, ensuring clarity and compliance. By utilizing the Form 2159 (.pdf), you can simplify the payroll deduction process significantly. Consider accessing US Legal Forms for a reliable source to obtain and learn more about this form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.