Get Cuyahoga County Exempt Conveyance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cuyahoga County Exempt Conveyance Form online

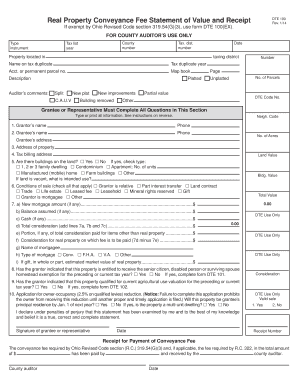

Filling out the Cuyahoga County Exempt Conveyance Form accurately is essential for processing property transactions that may be exempt from certain fees. This guide provides clear, step-by-step instructions to assist users in completing the form online with confidence.

Follow the steps to successfully complete the Cuyahoga County Exempt Conveyance Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the necessary information in the designated fields. Start with the details of the grantor, including their name and phone number, as required.

- Input the grantee's information next, which includes their name, phone, and complete address. Ensure that this data matches the deed to avoid any discrepancies.

- Provide the address of the property being conveyed, including the street number and name. This should be as clear and precise as possible.

- List the tax billing address where property tax notifications should be directed. It is crucial to ensure that this address is accurate to prevent tax issues.

- Indicate whether there are any buildings on the land by selecting 'Yes' or 'No'. If there are buildings, specify the types present; options range from single-family dwellings to agricultural structures.

- Detail any conditions of sale that apply to the property. Check all relevant boxes that may affect the consideration or value of the property being conveyed.

- Complete the financial information relating to mortgages and cash payments, ensuring all amounts are accurate and properly calculated.

- If applicable, indicate whether the property qualifies for any exemptions such as senior citizen or agricultural use valuations, and complete any required supplemental forms.

- Finally, review all provided information for accuracy. After confirming everything is correct, save changes, and proceed to download, print, or share the completed form as needed.

Complete the Cuyahoga County Exempt Conveyance Form online today to ensure a smooth property transaction.

To protest property taxes effectively, gather strong evidence to support your claim, such as recent property appraisals, comparable sales data, and photographs of your property. Use the Cuyahoga County Exempt Conveyance Form to file any necessary documentation related to exemptions. Presenting detailed information can strengthen your case during the review process by local tax authorities. Knowing how to present your evidence can lead to a favorable outcome.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.