Loading

Get P And L Form 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the P And L Form online

Filling out the P And L Form online is an essential task for tracking financial performance. This guide provides clear, step-by-step instructions to help users accurately complete each section of the form.

Follow the steps to successfully complete the P And L Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

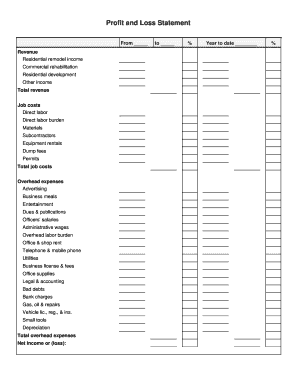

- Begin by entering the date range for the profit and loss statement at the top of the form, indicating the period from which you are reporting income and expenses.

- In the revenue section, fill in the details of your income sources, including residential remodel income, commercial rehabilitation, residential development, and any other income. Make sure to sum these amounts to derive the total revenue.

- Proceed to the job costs section. Document each job cost category, such as direct labor, direct labor burden, materials, subcontractors, equipment rentals, dump fees, and permits. Again, sum these to find the total job costs.

- Move on to the overhead expenses section. Enter the relevant costs for advertising, business meals, entertainment, dues & publications, officers' salaries, administrative wages, and other overhead categories. Calculate the total overhead expenses.

- Finally, calculate your net income or loss by subtracting total job costs and total overhead expenses from total revenue. Provide your year-to-date figures as necessary.

- Review the completed form for accuracy and completeness. Once satisfied, you can save changes, download, print, or share the form as needed.

Start filling out your documents online today for a more organized financial overview.

In construction, P and L refers to the profit and loss associated with specific projects. It helps contractors evaluate the costs incurred versus the revenue generated from their construction projects. Utilizing a P And L Form in your project management can facilitate better financial planning and review, ultimately leading to enhanced project profitability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.