Loading

Get Grantor Trust Letter Example 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Grantor Trust Letter Example online

This guide provides a comprehensive overview of how to effectively fill out the Grantor Trust Letter Example online. Whether you are new to the process or seeking clarification, this step-by-step guide will assist you in completing the form accurately.

Follow the steps to successfully complete the Grantor Trust Letter Example.

- Begin by locating the Grantor Trust Letter Example form. To access the form, click the ‘Get Form’ button that appears on your screen. This action will enable you to download and open the document in your preferred editor.

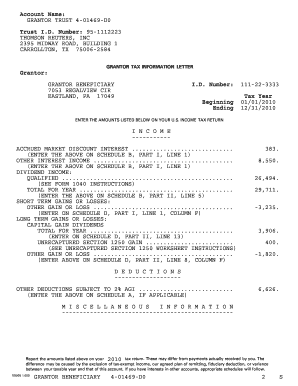

- Input the account name and Trust I.D. Number in the corresponding fields. Ensure that these identifiers correctly match the information listed in your tax records.

- Fill in the details for the grantor and grantor beneficiary. Enter their names and addresses as per your documents to ensure compliance with IRS requirements.

- Specify the I.D. numbers for both the grantor and grantor beneficiary. Input these numbers carefully to avoid delays or issues with processing.

- Document the tax year you are reporting. Insert the beginning and ending dates that correspond to the tax year applicable to your entries.

- Proceed to fill out the income information presented in the table. For each category, input the amounts accurately as they appear in your financial statements.

- Complete the deductions section by entering any deductions that apply. This includes other deductions subject to the 2% AGI limit.

- Review all sections for accuracy. Ensure that every detail is filled in correctly and that your figures are precise.

- Once you are satisfied with the entries, save your changes. You may also choose to download, print, or share your completed form for future reference.

Begin filling out your Grantor Trust Letter Example online today for a smooth tax reporting process.

Related links form

An example of a grantor could be a parent who sets up a trust for their children to manage their inheritance. In this case, the parent retains control of the trust while alive. Exploring a Grantor Trust Letter Example can illustrate how different scenarios can define the term 'grantor' in trust law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.