Loading

Get Arkansas W2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Arkansas W2 Form online

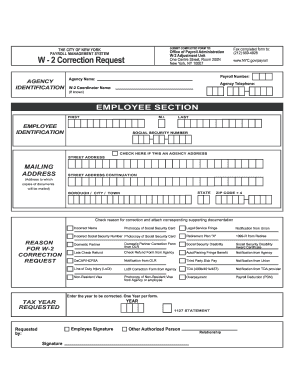

Filling out the Arkansas W2 Form online is a straightforward process that helps ensure accurate reporting of wages and taxes. This guide will walk you through each section of the form, providing detailed instructions to assist you in completing it correctly.

Follow the steps to complete the Arkansas W2 Form online.

- Click ‘Get Form’ button to obtain the Arkansas W2 Form and open it in the editor.

- Begin by entering your employer's details, including the employer's name, address, and payroll number. Ensure that this information is accurate as it is crucial for correct processing.

- Next, fill in your personal details. This includes your first name, middle initial, last name, and social security number. Double-check these entries for accuracy.

- Complete the mailing address section. Provide the street address, city, state, and zip code where you receive your mail. If applicable, indicate if this is your agency’s address.

- Select the reason for correction if applicable, and attach the necessary supporting documentation that corresponds to your reason. This could include a photocopy of your social security card or other specified documents.

- Indicate the tax year you need corrected by entering the year in the designated field. Remember that each form is only for one specific year.

- Lastly, sign the form. The signature field should include your name and any other authorized person's name along with their relationship to you, if necessary.

- Once you have completed the form, you can save your changes, download a copy for your records, print it, or share it as needed.

Start completing your Arkansas W2 Form online today.

Whether you must file an Arkansas state tax return depends on several factors, such as your income level and filing status. If you've received income subject to state tax, including wages reflected in your Arkansas W2 Form, it is typically necessary to file. It’s advisable to consult the state’s guidelines or seek assistance from tax professionals to confirm your filing obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.