Loading

Get Rpd 41373 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Rpd 41373 online

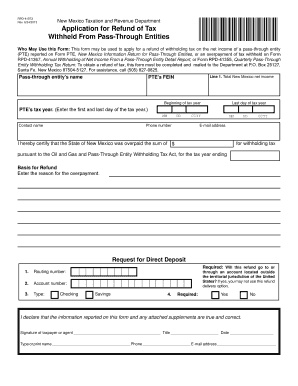

Filling out the Rpd 41373 form is an essential step for pass-through entities seeking to apply for a refund of withholding tax. This guide provides you with user-friendly, step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to successfully complete the Rpd 41373 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the pass-through entity (PTE) in the designated field. Make sure to use the official name as registered.

- Provide the PTE’s Federal Employer Identification Number (FEIN) in the appropriate field to ensure accurate identification.

- Indicate the beginning and last day of the tax year for which the refund is being claimed, using the MM/DD/YYYY format.

- Fill in the contact name of the person responsible for the refund request, as well as their phone number and e-mail address.

- State the total amount of overpayment in the section labeled 'I hereby certify that the State of New Mexico was overpaid the sum of $', followed by the reason for the overpayment in the 'Basis for Refund' section, ensuring clarity and detail.

- Complete the direct deposit section by providing the routing number, account number, and type of account (checking or savings). Ensure that the provided information is accurate to avoid delays.

- Answer the question regarding whether the refund will go to or through an account outside the territorial jurisdiction of the United States, selecting 'Yes' or 'No' as appropriate.

- Sign and date the form in the designated area to certify that the information provided is true and correct. Type or print the name of the signer.

- Once all fields are completed, save your changes, download the form, or print for your records. If ready to submit, mail the form to the address listed: New Mexico Taxation and Revenue Department, P.O. Box 25127, Santa Fe, NM 87504-5127.

Now that you have your guide, start filling out the Rpd 41373 online with confidence.

To get the RPD for New Mexico, you can visit the New Mexico Taxation and Revenue Department's website or contact them directly for assistance. The Rpd 41373 form is necessary for several tax-related matters, and accessing it online provides guidance on filling it out. Understanding this form can aid in complying with state tax regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.