Loading

Get Pf Form 12

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pf Form 12 online

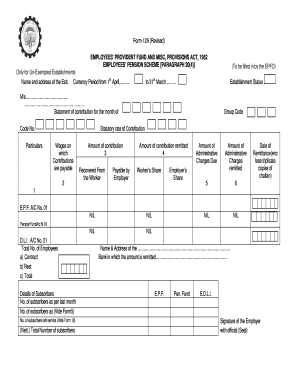

Filling out the Pf Form 12 online is a straightforward process that allows employers to provide essential contribution details for their employees. This guide offers step-by-step instructions to ensure accurate completion and submission of the form.

Follow the steps to complete the Pf Form 12 accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the name and address of the establishment at the top of the form. Ensure that the currency and the period for contributions, from 1 April to 31 March, are clearly indicated.

- Select the establishment status and provide the name of the organization (M/s) along with any additional required details.

- Enter the statement of contributions for the month, including the code number and any specific particulars as dictated by the form instructions.

- Detail both the statuary rate of contribution and the wages on which contributions are payable, ensuring accuracy.

- Record the amount of contributions recovered from the worker, the amount payable by the employer, and ensure the amounts are reflected in the relevant fields.

- Fill in the amounts of administrative charges remitted, and the due administrative charges, keeping the figures clear and correct.

- Complete the section on the total number of employees, breaking it down into contract and rest employees.

- Provide details of subscribers, including the number of subscribers as per the last month and any who have left service.

- Finally, include the name and address of the bank where the amount is remitted and ensure that the signature of the employer with the official seal is present.

- Once all sections are completed, save changes, download, print, or share the form as needed.

Complete your Pf Form 12 online today for efficient document management.

The PF 12% amount refers to the portion of your basic salary that is contributed to your Provident Fund account. This is a mandatory contribution for employees under the EPF scheme, aimed at securing their financial future. Understanding your PF Form 12 can help you monitor these contributions effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.