Loading

Get Form 10fa Word Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 10fa Word Format online

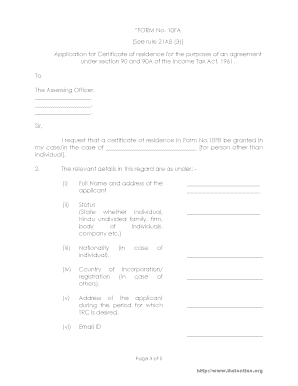

This guide provides clear, step-by-step instructions on how to accurately fill out the Form 10fa Word Format online. By following these steps, users can ensure their application for a certificate of residence is completed correctly.

Follow the steps to complete the Form 10fa online.

- Click the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- In the first section, provide your full name and address as the applicant. This information is crucial for identification.

- Specify your status. Indicate whether you are an individual, Hindu undivided family, firm, body of individuals, company, or another category.

- Fill in your nationality. If you are an individual, enter your nationality here.

- For entities, specify the country of incorporation or registration.

- Enter the address where you will reside during the period for which the Tax Residency Certificate (TRC) is sought.

- Provide your email address for communication purposes.

- If applicable, include your Permanent Account Number (PAN) or Taxpayer Identification Number (TAN).

- State the basis on which your status of being a resident in India is claimed.

- Indicate the period for which the residence certificate will apply.

- Specify the purpose for obtaining the Tax Residency Certificate.

- Add any other relevant details that may support your application.

- Attach supporting documents as required. Clearly list these documents.

- In the verification section, fill in your full name in block letters, your relationship to the applicant if applicable, and your designation if you are filing on behalf of another person.

- Verify the form by signing it and date it appropriately. Ensure your name is also printed clearly.

- Once you have completed all sections, save your changes. You may then download, print, or share the completed form as needed.

Complete your Form 10fa online today for a smooth application process.

Form 10F is filed by those NRIs receiving payments from India who do not have PAN and required NRI's Tax Residency Certificate details. This form helps them to avoid TDS on the payments accrued or received in India.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.