Loading

Get Substitute Form W 8ben E For Canadian Entities 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Substitute Form W-8BEN-E for Canadian entities online

Filling out the Substitute Form W-8BEN-E is crucial for Canadian entities receiving income from the United States. This guide provides clarity on each section of the form, ensuring a smooth and efficient process for users, no matter their prior experience with tax documents.

Follow the steps to complete the form accurately and efficiently

- Click the 'Get Form' button to obtain the form and open it in your preferred digital editing tool.

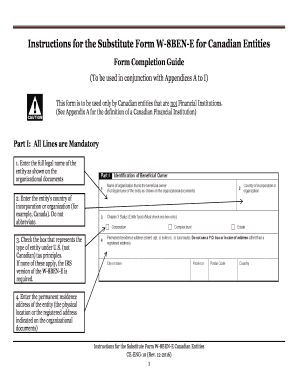

- Enter the full legal name of the entity as it appears on official organizational documents. This ensures your identity is accurately represented.

- Provide the entity's country of incorporation or organization. Be sure to spell 'Canada' in full, without any abbreviations.

- Select the appropriate box that describes the type of entity according to U.S. tax principles. If none apply, you may need to consider the IRS version of the W-8BEN-E.

- Input the permanent residence address of the entity, ensuring it matches the physical or registered address from your organizational documents.

- If eligible, complete Part II regarding reduced rates of withholding under the Canada – U.S. Tax Treaty. Choose the country name (Canada) and indicate any applicable Limitation on Benefits provision.

- For any special rates and conditions claimed, specify the Treaty article and paragraph, tax rate, type of income, and confirm how the entity meets the Tax Treaty provisions.

- In Part III, check the box that reflects the entity's FATCA status, selecting between Active NFFE, Passive NFFE, or other classifications.

- Complete Part IV if applicable, providing details of all Controlling Persons if the entity is classified as a Passive NFFE.

- Finalize the form by having it signed and dated by an authorized representative or officer, ensuring the box confirming authority to sign is checked.

- After reviewing all entered information, save changes, and consider downloading, printing, or sharing the completed form as necessary.

Begin filling out your Substitute Form W-8BEN-E online today to ensure compliance and access potential tax benefits.

You can download the W-8BEN form directly from the US Legal Forms website. We provide an easy-to-navigate interface where you will find the Substitute Form W 8ben E For Canadian Entities as well. Accessing these forms is simple, making it convenient for you to complete your tax documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.