Get Schedule Iii (a) 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SCHEDULE III (a) online

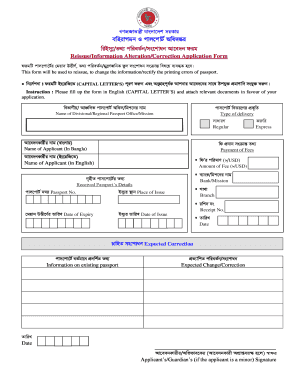

Filling out the SCHEDULE III (a) online can seem daunting, but this guide is designed to simplify the process. This document is necessary for individuals seeking to reissue, alter, or correct information on their passport. Follow the steps below to complete the form confidently.

Follow the steps to complete the SCHEDULE III (a) form online.

- Press the ‘Get Form’ button to access the document and open it in your editor.

- Begin by entering the name of the divisional or regional passport office or mission where you will submit the application.

- Select the type of delivery you require: Regular or Express.

- Fill in the name of the applicant in Bangla and in English, ensuring to use capital letters as specified.

- Enter the amount of fee required for the application in USD.

- Provide the bank or mission details related to your application.

- If applicable, include details of any previously received passport, such as passport number, place of issue, date of expiry, and date of issue.

- Clearly indicate the expected correction or change needed to the existing passport information, including dates and relevant details.

- If the applicant is a minor, include the signature of the applicant’s guardian.

- Review all entries for accuracy and completeness; then proceed to save changes, download, print, or share the completed form.

Complete your SCHEDULE III (a) form online today to ensure a smooth application process.

Yes, an individual taxpayer with a net capital loss can deduct up to $3000 against ordinary income each year. This rule helps mitigate the impact of investment losses on your overall tax bill. Understand the importance of utilizing SCHEDULE III (a) to effectively report these losses, ensuring you maximize your tax advantages. Having a reliable tool from uslegalforms can simplify this deduction process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.