Loading

Get 1601c 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1601c online

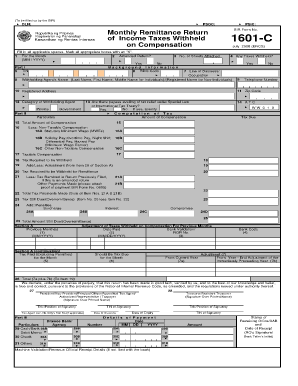

The 1601c form, known as the Monthly Remittance Return of Income Taxes Withheld on Compensation, is essential for withholding agents required to deduct and remit taxes. This guide aims to support users in understanding and accurately filling out the form online, ensuring compliance with tax regulations.

Follow the steps to successfully complete the 1601c form online.

- Press the ‘Get Form’ button to access the 1601c form and open it in the provided editor.

- Enter the Document Locator Number (DLN) in the specified field.

- Input the PSOC (Payment Source Code) in the appropriate space.

- Specify the month for which you are filing the return by entering the month and year in the formatted (MM/YYYY) field.

- Indicate if this is an amended return by marking the appropriate box with an 'X'.

- If applicable, enter the number of sheets attached.

- Answer the question regarding whether there are any taxes withheld and check 'Yes' or 'No'.

- Complete Part I by filling in your TIN, RDO Code, line of business or occupation, the withholding agent's name, phone number, registered address, zip code, and category of withholding agent (Private or Government).

- In part II, indicate if there are payees availing of tax relief under special law or international tax treaty, specifying as needed.

- Calculate the total amount of compensation and fill in the tax due, subtracting any non-taxable compensation such as minimum wage earners' income and other allowances.

- Fill in the tax required to be withheld, adjustments, and total tax payments made.

- Complete the section for any penalties, interest, or compromises, if applicable.

- Review the declaration portion affirming the return's accuracy, and provide the signature, title, and TIN of the signatory.

- Finally, users can save any changes, download the completed form, print it, or share it as necessary.

Complete your 1601c form online today to ensure compliance and avoid penalties.

Generating a tax certificate requires you to gather your financial information first. After that, you can use templates available on the US Legal Forms platform to create the document. These templates guide you through each step, ensuring you include all necessary details. Once completed, review the certificate for accuracy before submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.