Get Freddie Mac Form 65 7/05 (rev 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac Form 65 7/05 (rev online

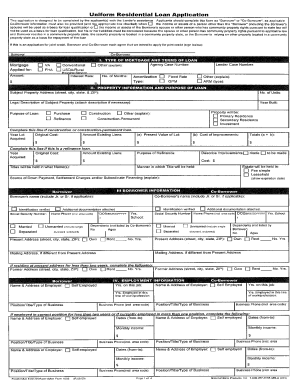

The Freddie Mac Form 65 7/05 (rev) is an important document used in the loan process for mortgage applications. This guide provides clear, step-by-step instructions on how to fill it out effectively, ensuring that users complete the form accurately and efficiently.

Follow the steps to successfully fill out the Freddie Mac Form 65 7/05 (rev) online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editing application.

- Begin by entering the borrower’s name in the designated field at the top of the form. Ensure the spelling is accurate and complete.

- Provide the mailing address of the borrower in the corresponding section, including the street address, city, state, and zip code.

- Input the Social Security Number of the borrower in the appropriate field. Double-check to avoid any errors.

- In the next section, specify the type of mortgage being applied for; select options such as fixed-rate or adjustable-rate as applicable.

- Detail the loan amount requested in the designated area. Be sure to reflect this accurately.

- Complete the employment and income details by filling out the employer's information and the income details for the past two years in the required sections.

- Fill in your financial obligations, including any current debts such as car loans, student loans, or credit card debts.

- Review all the information filled in the form to ensure accuracy and completeness, making necessary adjustments as needed.

- Once all sections are completed, save your changes, then download, print, or share the form as required.

Ensure a smooth process by completing your forms online today.

The Freddie Mac 240 rule stipulates that borrowers must make a minimum down payment of 3% for certain mortgage products. This requirement is applicable to first-time homebuyers and helps facilitate easier access to home financing. Adhering to the 240 rule allows Freddie Mac to encourage responsible borrowing while ensuring the sustainability of the mortgage market. Utilizing the Freddie Mac Form 65 7/05 (rev) assists lenders in complying with this guideline.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.