Loading

Get Ga W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ga W4 online

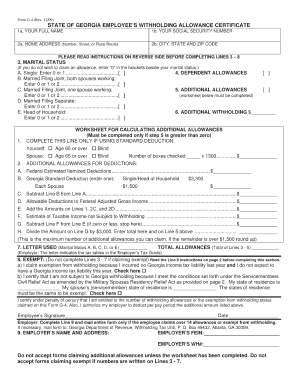

The Ga W4 form is essential for calculating the correct amount of state income tax to withhold from your paycheck. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to accurately complete your Ga W4 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your personal information, including your name, address, and filing status. Make sure to use the full name you use for tax purposes.

- Indicate the number of allowances you are claiming on the form. This section is crucial as it affects how much tax is withheld from your pay.

- Identify any additional amount you wish to have withheld. If you expect to owe additional taxes, provide that amount in this section.

- Review the completed sections for accuracy. Ensure all information is correct and reflects your current tax situation.

- Once you have verified everything, you can save changes, download, print, or share the completed form as needed.

Complete your Ga W4 online today and ensure your tax withholdings are accurate!

To determine if you are exempt from Georgia withholding, review the criteria outlined on the GA W4 form. Generally, you must meet specific income thresholds or circumstances indicating that you owe no tax for the year. If you believe you qualify, you can mark the appropriate section on the form. For complex situations, consider seeking guidance from a tax professional.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.