Get Form R 19026 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form R 19026 online

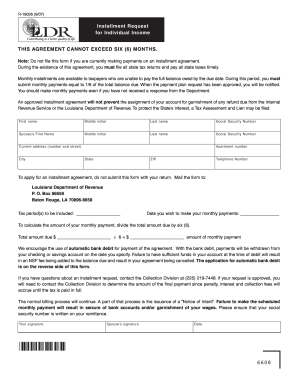

This guide provides clear instructions on how to complete the Form R 19026, an installment request for individual income. Filling out this form correctly is essential for taxpayers who need to request monthly payment plans with the Louisiana Department of Revenue.

Follow the steps to successfully complete the Form R 19026 online.

- Click the ‘Get Form’ button to obtain the form and access it in your document editor.

- Enter your first name, middle initial, and last name in the designated fields.

- Provide your Social Security number to ensure accurate identification.

- If applicable, fill in your spouse's first name, middle initial, last name, and Social Security number.

- Input your current address, including the street number and name, city, apartment number (if any), state, and ZIP code.

- Enter your telephone number for communication regarding your installment request.

- Indicate the tax period or periods that this request will cover.

- Specify the date you wish to start making monthly payments.

- Calculate your monthly payment amount by dividing the total amount due by six and enter the calculated figure.

- Consider opting for automatic bank debit to streamline monthly payments; fill in your financial institution details and account information.

- Read the verification statement, then provide your signature and date. If applicable, repeat this for your spouse.

- Once all fields are completed, save your changes, download your form, and prepare to mail it to the specified address.

Complete your Form R 19026 online today to take control of your payment plan.

Get form

To set up a payment plan for Louisiana state taxes, you should first gather all relevant tax documents, including Form R 19026. Visit the Louisiana Department of Revenue's website for detailed instructions on establishing a payment arrangement. Resources like US Legal Forms can also guide you through this process, providing the necessary forms and support for managing your tax payments easily. It's essential to take this step to avoid penalties and ensure you're on track.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.