Get Mi W4

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mi W4 online

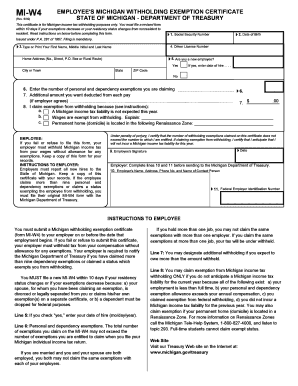

The Mi W4 form is essential for employees in Michigan to determine their income tax withholding. This guide provides clear and supportive instructions for filling out the form online, ensuring you understand each component and its significance.

Follow the steps to complete your Mi W4 form online.

- Click 'Get Form' button to acquire the Mi W4 form and access it in your preferred editing tool.

- In the first section, enter your social security number. This number is crucial for tax identification purposes.

- Type or print your first name, middle initial, and last name clearly. This ensures proper identification.

- Provide your driver license number, which also assists in validating your identity.

- Fill in your home address, including the street number, street name, city or town, state, and ZIP code.

- Enter your date of birth. This information is necessary for age verification purposes.

- Indicate if you are a new employee by selecting 'Yes' or 'No.' If yes, enter your date of hire.

- List the number of personal and dependency exemptions you are claiming. Ensure that this number does not exceed your entitlement when you file your income tax return.

- If applicable, enter any additional amount of money you wish to have deducted from each paycheck.

- Claim exemption from withholding if you expect no Michigan income tax liability, providing the necessary rationale based on the options provided on the form.

- Sign and date the form at the bottom, certifying that your claims are truthful and accurate.

- Review the filled form for accuracy, then save your changes, and choose to download or print the document for submission.

Complete your Mi W4 form online today to ensure your tax withholdings are accurate.

The Michigan W4 allowance refers to the number of exemptions you claim on your MI W4 form, which directly impacts your income tax withholding. Each allowance you claim reduces your taxable income, which can result in a lower amount withheld from your paycheck. Understanding how many allowances to claim will depend on your individual tax situation. If you need more help navigating this, resources like US Legal Forms can provide valuable assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.