Loading

Get W4 Indiana

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 Indiana online

Completing the W4 Indiana form is essential for ensuring accurate tax withholding for your income. This guide will provide you with step-by-step instructions to fill out the form online effectively.

Follow the steps to fill out the W4 Indiana form online successfully.

- Click 'Get Form' button to obtain the W4 Indiana form and open it in the designated editor.

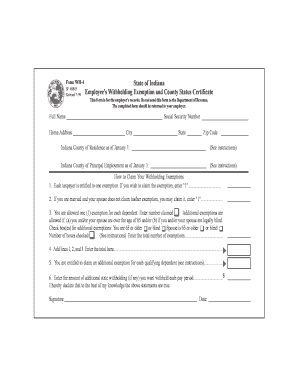

- Enter your full name, social security number, and home address in the appropriate fields on the form.

- Indicate your Indiana county of residence and principal employment as of January 1 in the designated sections.

- Claim your withholding exemptions by following these guidelines: write '1' if you are claiming your own exemption, enter '1' if you are married and your spouse does not claim their exemption, then calculate the total number of exemptions for dependents and add any additional exemptions for age or blindness by checking the appropriate boxes.

- Add the total claimed exemptions from lines 1, 2, and 3 and write the sum in the box provided.

- If applicable, enter any additional exemptions for qualifying dependents on the specified line.

- Decide if you wish to withhold any additional amount from your pay each period and enter that amount in the designated box.

- Review all the information you entered for accuracy before proceeding to sign and date the form in the appropriate fields.

- Once completed, save your changes, and you may choose to download, print, or share the W4 Indiana form as needed.

Start filling out your W4 Indiana form online today to ensure proper tax withholding.

Indiana's state payroll tax primarily consists of the state income tax, which is approximately 3.23%. Local government may impose additional payroll taxes, and these vary by county. It is essential to check local tax rates as they can significantly affect your payroll deductions. Using the W4 Indiana will help clarify your payroll tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.