Loading

Get Vat Full Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Vat Full Form online

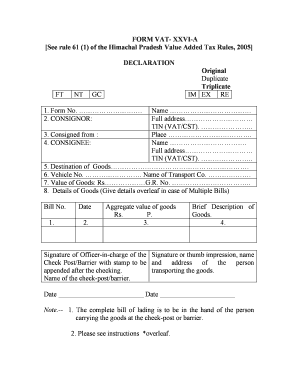

Filling out the Vat Full Form is an essential process for ensuring compliance with taxation regulations. This guide provides you with step-by-step instructions to complete the form accurately and efficiently.

Follow the steps to fill out the Vat Full Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the form number in the designated space. This is crucial for identification purposes.

- Provide the name and full address of the consignor in the respective fields. Ensure accuracy in this information.

- Enter the TIN (VAT/CST) number of the consignor, which is necessary for tax identification.

- In the next section, indicate the place from which the goods are consigned.

- Then, fill in the information for the consignee, including their name, full address, and TIN (VAT/CST).

- Specify the destination of the goods in the provided field.

- Provide the vehicle number and the name of the transport company responsible for delivering the goods.

- Next, enter the value of the goods in the appropriate section and the G.R. number as well.

- List the details of the goods. If multiple bills are involved, continue on an additional page if needed, including bill number, date, aggregate value, and brief description.

- Obtain the signature and imprint of the responsible officer at the check post or barrier, along with the name of the check post.

- Review all entered information for accuracy before saving the form. Ensure that dates are filled correctly.

- Once all information is completed, you can save changes, download the form, print it, or share it, as needed.

Start filling out your documents online today for a smooth process.

You can find the applicable VAT by reviewing your sales invoices and consulting tax regulations related to your industry. Additionally, platforms like uslegalforms offer resources to help you determine VAT amounts accurately. Understanding the Vat Full Form aids significantly in identifying VAT across different transactions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.