Loading

Get Indusind Bank Form 15g Online Submission

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indusind Bank Form 15g Online Submission online

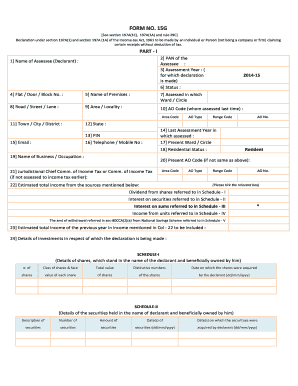

Indusind Bank Form 15g serves as a declaration for individuals who wish to claim certain receipts without the deduction of tax, as per the Income Tax Act, 1961. This guide will walk you through the process of completing the form online in a clear and supportive manner.

Follow the steps to successfully complete your submission.

- Press the ‘Get Form’ button to access the form and prepare it for editing.

- Begin by entering your name in the 'Name of Assessee (Declarant)' field as it appears on your official documents.

- Provide your PAN (Permanent Account Number) in the relevant section, as this identifies you for tax purposes.

- Enter the assessment year for which you are making this declaration; this is typically the financial year relevant to your income.

- Fill out your residential address, including flat or door number, road or street name, area or locality, town or city, and state for identification purposes.

- Indicate your status (e.g., individual, resident) in the designated field to clarify your tax position.

- For income mentioned in the form, estimate your total income from various sources and check the relevant boxes that apply.

- Complete the details of investments (if applicable) in the specified schedules — I through V, providing clear descriptions and values of shares, securities, sums, or mutual fund units.

- Review your entries carefully to ensure all information is accurate and complete, fulfilling the necessary requirements under the Income Tax Act.

- Finalize your declaration by signing in the provided space, confirming that the information is truthful and complete.

- Upon completing the form, save your changes and proceed to download, print, or share the form as needed for your records.

Complete your Indusind Bank Form 15g Online Submission today and ensure compliance with tax regulations.

To fill out the Form 15G PDF, first download the form from the IndusInd Bank website. Open the PDF in any PDF editor and enter the required information, such as your name, address, and income details. Once completed, print the form and submit it as per the instructions provided.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.