Loading

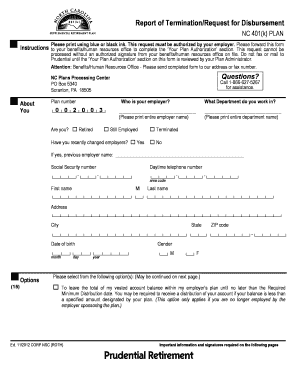

Get North Carolina 401 K Report Of Termination Request For Disbursement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the North Carolina 401 K Report Of Termination Request For Disbursement online

This guide provides a comprehensive overview of how to complete the North Carolina 401 K Report Of Termination Request For Disbursement online. By following these step-by-step instructions, users can efficiently navigate the form and ensure their requests are processed accurately.

Follow the steps to complete your termination request for disbursement.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor. Ensure you have the necessary tools to fill out the form accurately.

- Begin by entering your personal information in the 'About You' section. This includes your plan number, employer name, current employment status, and contact details such as your social security number and daytime telephone number.

- Proceed to the 'Options' section. Choose how you want to handle your vested account balance. You can opt to leave it within the employer's plan or select a direct rollover to another account.

- If you select a direct rollover, indicate the types of money in your account and specify whether you want to roll over the entire account or a portion. Fill out the details regarding the account you are rolling over to.

- In the 'Partial Single Sum' section, enter the specific amount you wish to receive in a check if applicable. Make sure to check the appropriate boxes to indicate the type of contributions you are withdrawing.

- Complete the 'Electronic Fund Transfer' section if you wish to receive your payment via EFT. Fill in the financial institution's name and your account details, ensuring that you attach a voided check.

- Review the tax withholding sections carefully. Fill out the federal and state income tax withholding sections based on your preferences. Consult with a tax advisor if needed to understand the implications.

- Read and acknowledge the 'Your Authorization' section. Provide your signature, date, and ensure that the form is authorized by your benefits/human resources office before submission.

- Finally, save your changes, then download, print, or share the completed form as required.

Complete your document online today for a smoother disbursement process.

If you get terminated from your job, you have the ability to cash out the money in your 401(k) even if you haven't reached 59 1/2 years of age. This includes any money you've contributed and any vested contributions from your employer -- plus any investment profits your account has generated.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.