Loading

Get Form 3567 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 3567 online

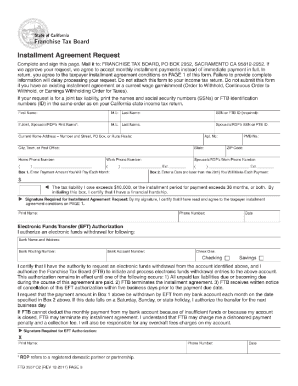

Filling out the Form 3567 online can streamline the process of requesting an installment agreement with the California Franchise Tax Board. This guide provides clear instructions on completing each section of the form to ensure a successful submission.

Follow the steps to complete your Form 3567 online.

- Click the ‘Get Form’ button to obtain the form and open it in the appropriate editor.

- Enter your personal information in the specified fields, including your name, address, and contact numbers. If applicable, include the information for your partner.

- Indicate the monthly payment amount you will make as part of your installment agreement by filling in Box 1.

- Specify the date you wish to make each payment in Box 2. Remember that this date must be no later than the 28th of each month.

- If your tax liability exceeds $10,000, or if your installment period exceeds 36 months, initial the box to confirm financial hardship.

- Sign and print your name at the designated area to certify your understanding and compliance with the taxpayer installment agreement conditions.

- Complete the Electronic Funds Transfer (EFT) authorization section by providing your bank information, including the bank name, routing number, and account number.

- Once all sections are filled out accurately, review the entire form for any errors, and then save your changes, download a copy for your records, or proceed to submit the form as instructed.

Complete your Form 3567 online today to take the first step towards managing your tax liability.

You can obtain California tax forms, including Form 3567, through the California Franchise Tax Board's official website. Many forms are available for download in PDF format, making it easy to print and fill out at your convenience. If you prefer physical copies, you may also request them from local tax offices.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.