Loading

Get Freddie Mac Form 439 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Freddie Mac Form 439 online

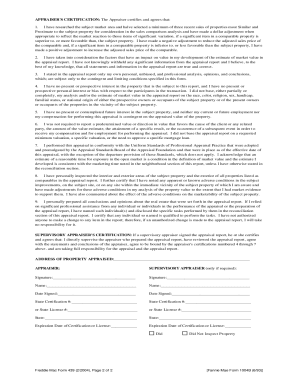

Freddie Mac Form 439 is a crucial document used in the appraisal process, providing a framework for appraisers to certify the market value of a property. This guide offers step-by-step instructions on how to fill out the form online to ensure accurate and efficient completion.

Follow the steps to complete the Freddie Mac Form 439 online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by filling out the address of the property appraised in the designated section. This area is critical as it identifies the property in question.

- Navigate to the appraiser's certification section. Here, enter your full name, state certification or license number, and expiration date. Ensure all information matches your official documentation.

- Indicate whether you inspected the property by selecting 'Did Inspect Property' or 'Did Not Inspect Property'. This is essential for transparency in the appraisal process.

- In each subsequent section, provide information regarding market comparisons and value estimations based on your analysis. Make sure to adjust figures as necessary based on the conditions specified in the component instructions.

- Complete all sections regarding contingent and limiting conditions, ensuring that you accurately represent any factors affecting the appraisal outcome.

- Review all entered information carefully for accuracy and completeness. This helps prevent any potential issues or delays.

- Once you have filled out the form, save your changes, and choose to download, print, or share the document as necessary based on your needs.

Complete your Freddie Mac Form 439 online today for a streamlined appraisal process.

Freddie Mac maintains specific capital requirements to ensure financial stability. These requirements are designed to protect both borrowers and the organization. Familiarizing yourself with these capital standards will be beneficial when preparing your financial documents, such as those outlined in the Freddie Mac Form 439.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.