Get Tax Rules 2005 Form No 9

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Rules 2005 Form No 9 online

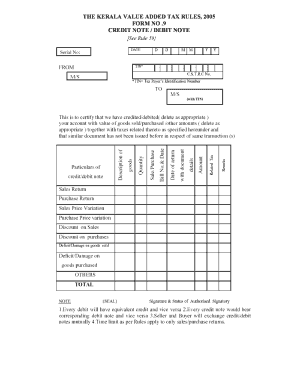

Filling out the Tax Rules 2005 Form No 9 online is a crucial process for managing credit and debit notes. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your Tax Rules 2005 Form No 9 online.

- Click the ‘Get Form’ button to access the form and open it in the designated online editor.

- Review the introductory section of the form, which provides essential information about the document and its purpose. Ensure you understand the requirements for the credit or debit note before proceeding.

- Fill in your details in the designated fields. This typically includes your name, business identification number, and contact information. Double-check for accuracy as this information is critical for your records.

- Proceed to complete the transaction details. Include information such as the invoice number, date of issue, and the relevant amounts for the credit or debit note. It is important to ensure that all figures match your accounting records.

- Review the additional notes or comments section if applicable. Use this space to provide any context or explanations that may help clarify the transaction for the recipient.

- Once you have filled out all required fields, review the form for completeness and accuracy. This step is crucial to avoid any processing delays.

- After you have verified that the information is correct, save your changes. The online platform usually provides options to download, print, or share the completed form directly from the editor.

Complete your Tax Rules 2005 Form No 9 online today to ensure your credit and debit notes are processed efficiently.

An organization must collect the W-9 form when they plan to make payments to an individual or business that requires tax reporting on those payments. This includes independent contractors, freelancers, and vendors providing services or products. Following the Tax Rules 2005 Form No 9 helps organizations maintain compliance and prevents issues during tax season. The US Legal Forms platform offers resources to ensure you collect W-9 forms efficiently and accurately.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.