Loading

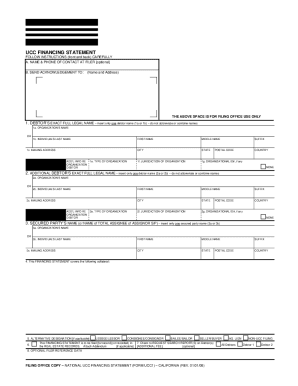

Get Ucc 1 Financing Statement California 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ucc 1 Financing Statement California online

Filling out the Ucc 1 Financing Statement in California is essential for securing interest in personal property. This guide provides clear, step-by-step instructions on how to accurately complete the form online while ensuring compliance with California regulations.

Follow the steps to successfully complete the Ucc 1 Financing Statement online.

- Click ‘Get Form’ button to obtain the Ucc 1 Financing Statement and open it in your preferred editing tool.

- Begin filling out the form by entering the Debtor's exact full legal name in item 1. Ensure you only input one Debtor name, which could be either an organization or an individual, depending on the situation.

- If applicable, proceed to item 2 and provide any additional Debtor's name, following the same format as in item 1.

- In item 3, enter the name of the Secured Party or Total Assignee. Again, input only one name and follow proper legal naming conventions.

- Describe the collateral covered by this Financing Statement in item 4. If the space is insufficient, use Addendum (Form UCC1Ad) or additional sheets, ensuring to correctly format the name of the Debtor.

- Complete item 5 if you wish to use alternative designations for the roles of lessee/lessor or others, depending on your specific case.

- Fill out item 7 only if you wish to request a Search Report on the Debtor(s). Be mindful that there is an additional fee for this service.

- After all relevant fields are completed, you can choose to save changes, download, print, or share your form as needed.

Ensure your Ucc 1 Financing Statement is completed accurately by following these steps online.

The CA UCC, or California Uniform Commercial Code, encompasses laws that standardize commercial transactions in the state. It includes provisions regarding secured transactions, sales, and leases among others. Understanding the CA UCC is key for businesses engaging in credit and secured lending. Utilizing resources like USLegalForms can help you navigate these regulations effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.