Get Schedule Ia 126

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Schedule Ia 126 online

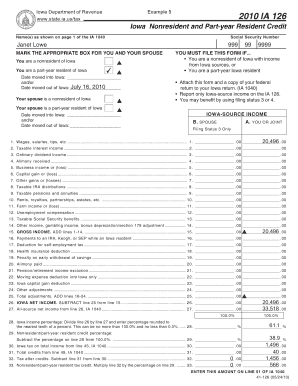

Filling out the Schedule Ia 126 is an important step for nonresidents and part-year residents of Iowa to claim their income credits accurately. This guide will walk you through the process of completing the form online, ensuring you have all the necessary information.

Follow the steps to complete the Schedule Ia 126 effectively.

- Press the ‘Get Form’ button to access the Schedule Ia 126 and open it in your preferred online editor.

- Provide your name as shown on page 1 of the IA 1040 along with your Social Security Number.

- Indicate your residency status by marking the appropriate box for you and your partner regarding nonresidency or part-year residency in Iowa.

- Enter the dates you moved into or out of Iowa, if applicable.

- List all applicable Iowa-source income on the form, including wages, interest, dividends, business income, and more, ensuring you report only income sourced from Iowa.

- Calculate your total gross income by adding lines 1-14.

- Next, detail any adjustments to your income, such as IRA contributions or alimony paid, across lines 16-24.

- Subtract your total adjustments from your gross income to find your Iowa net income.

- Complete the section for all-source net income using your IA 1040 data.

- Calculate your Iowa income percentage and nonresident/part-year resident credit percentage based on the provided formulas.

- Finally, calculate your Iowa tax after credits and determine your nonresident/part-year resident tax credit.

- Once all fields are completed, you can save changes, download, print, or share the Schedule Ia 126.

Complete your document online now to ensure accuracy and efficiency.

As of now, Iowa has not eliminated state income tax, and there are no official plans to do so in the near future. Changes may happen over time, but it’s essential to stay informed about legislative updates. When filing your taxes, using Schedule Ia 126 is still necessary for reporting your income. For the latest tax information and assistance, consider utilizing platforms like uslegalforms for resources and forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.