Loading

Get Form 7a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 7a online

Filling out the Form 7a online can seem daunting, but with the right guidance, it can be a straightforward process. This guide provides clear steps to help you complete the Form 7a correctly and efficiently.

Follow the steps to fill out the Form 7a with ease.

- Press the ‘Get Form’ button to access the form and load it in your browser.

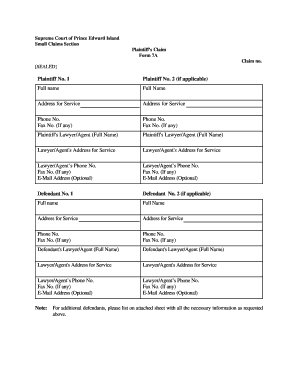

- Start by entering the claim number at the top of the form, which will be provided to you. This helps in tracking your claim in the court system.

- Fill in the section for Plaintiff No. 1 by providing your full name, address for service, and contact information, including phone and fax numbers if applicable.

- If there is a second plaintiff, complete the Plaintiff No. 2 section with the same required details.

- In the Plaintiff’s Lawyer/Agent section, if you are represented, provide their full name, address, phone number, and optional email address.

- Next, fill in the Defendant No. 1 section with the full name, address for service, and phone/fax information of the first defendant.

- If there is a second defendant, repeat the process in the Defendant No. 2 section.

- Select the type of claim by checking the appropriate box from the provided options, such as unpaid account, contract, or motor vehicle accident.

- In the 'Reasons for claim and details' section, clearly explain what happened, the amounts involved, and provide any necessary context for your claim.

- If you need more space, attach additional sheets as required, and if your claim is based on documents, mention if they are attached or explain why they are not.

- Finally, provide your signature and the date, and if required, the signature of the clerk.

- Once all sections are completed, you can save your changes, download a copy of the form, print it, or share it as needed.

Start filling out your Form 7a online today for a smoother legal process.

An ITIN number is not a work authorization and does not allow you to legally work in the US. It is solely for tax purposes, allowing you to file tax returns. If you wish to work legally in the US, you will need to obtain the appropriate work visa. For informational resources, uslegalforms can help clarify the distinctions between ITINs and work authorizations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.