Get How Do I Write A Mortgage Payoff Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How Do I Write A Mortgage Payoff Letter online

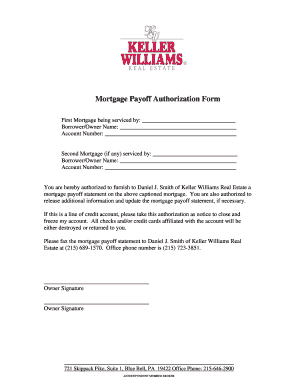

A mortgage payoff letter is an essential document that allows the lender to close out your mortgage account. This guide will help you navigate the process of filling out this letter online, ensuring that you provide all necessary information accurately and efficiently.

Follow the steps to complete your mortgage payoff letter online.

- Click ‘Get Form’ button to access the mortgage payoff letter form and open it in your preferred editor.

- Begin by filling in the details for the first mortgage being serviced. Include the name of the borrower or owner and the account number.

- In the authorization section, grant permission for the lender to furnish the mortgage payoff statement to the designated individual, including their name and associated real estate company.

- Provide the designated fax number for sending the mortgage payoff statement and include the office phone number for any necessary inquiries.

- Complete the form by signing it where indicated, and if required, secure a second signature.

- Once all fields are filled, save your changes, download the document for your records, or print it for submission.

Complete your mortgage payoff letter online today for a hassle-free experience.

To obtain a mortgage payoff letter, reach out to your lender using their specified communication methods. Provide the necessary details for identification and specify that you need the payoff letter. Following this, you should receive a formal letter outlining your total payoff amount. If you need guidance on how to write a mortgage payoff letter, consider using US Legal Forms for templates and examples.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.