Get Where To Mail Form 433 D 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Where To Mail Form 433 D online

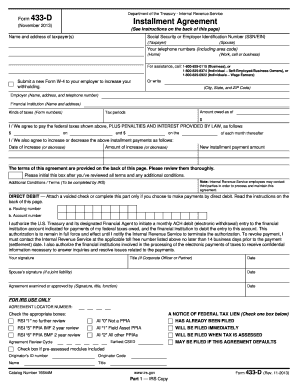

Filling out the Where To Mail Form 433 D is an important step in establishing an installment agreement with the IRS. This guide provides a clear and detailed process for completing the form online, ensuring that users can easily navigate through each section without confusion.

Follow the steps to complete the form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your online editor.

- Begin by entering the name and address of the taxpayer(s) in the designated fields. If this is a joint agreement, include the spouse's name as well.

- Fill in the Social Security or Employer Identification Number (SSN/EIN) for both the taxpayer and spouse.

- Provide your telephone numbers, including area codes, in the specified sections for home and work or mobile.

- List the employer's name, address, and phone number accurately to ensure proper communication.

- Indicate the financial institution's name and address where you hold your accounts.

- Specify the types of taxes owed by listing the respective form numbers and the tax periods involved, along with the total amount owed as of the date provided.

- Agree to the installment terms by outlining the payment amounts and schedule. Specify the payment amounts to be made on a monthly basis and any adjustments agreed upon.

- For payments by direct debit, complete the required sections by entering your routing number and account number after ensuring you have a voided check available.

- Sign and date the form where indicated. Ensure both taxpayer and spouse signatures are included if applicable.

- Once all sections are filled, save your changes, and download or print the form for submission. Follow mailing instructions for where to send the completed form to the IRS.

Take the first step towards your installment agreement by completing the Where To Mail Form 433 D online today.

To send your tax forms by mail, first print your completed forms and sign them where required. Next, place your forms in an envelope and affix the appropriate postage based on the weight of the envelope. Make sure to include any additional documentation that may be necessary. Finally, choose a secure mailing option, such as certified mail, for added security. If you need assistance determining how to proceed, resources like uslegalforms can provide valuable guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.