Define Fillable Fields In Electronic Loans Lending Templates For Free

How it works

-

Import your Loans Lending Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Loans Lending Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Define Fillable Fields In Electronic Loans Lending Templates For Free

Web-based PDF editors have demonstrated their dependability and effectiveness for executing legal documents.

And that’s how you can prepare and distribute any personal or corporate legal documents with just a few clicks. Try it out today!

- Upload a document to the editor. You can choose from several options - import it from your device or cloud storage or retrieve it from a template library, external link, or email attachment.

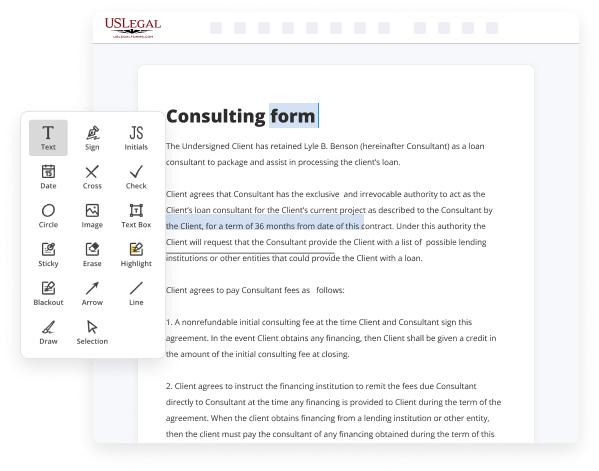

- Complete the empty fields. Place the cursor on the first blank area and use our editor’s navigation to move sequentially to avoid overlooking any part of your template. Utilize Text, Initials, Cross, and Check features.

- Make the necessary modifications. Revise the form with inserted images, draw lines and symbols, emphasize vital sections, or eliminate any irrelevant ones.

- Add additional fillable fields. Modify the template by introducing a new section for input if needed. Use the tool pane on the right side for this, place each field where you expect others to offer their information, and set the remaining fields as required, optional, or conditional.

- Arrange your pages. Eliminate pages that you no longer need or generate new ones using the appropriate key, rotate them, or alter their sequence.

- Create digital signatures. Click on the Sign feature and decide how you want to add your signature to the document - by typing your name, drawing it, uploading an image of it, or using a QR code.

- Share and submit for eSigning. Complete your editing by clicking the Done button and send your copy to others for approval via an email request, with a Fill Link option, in an SMS or fax message. Request a quick online notarization if needed.

- Save the document in the format you desire. Download your documents, store them in the cloud in their current format, or convert them as necessary.

Benefits of Editing Loans Lending Forms Online

Top Questions and Answers

The three main types of loans include secured loans, unsecured loans, and installment loans. Secured loans require collateral, which gives lenders assurance in case of default. Unsecured loans, on the other hand, do not require any collateral but usually come with higher interest rates. When you Define Fillable Fields In Electronic Loans Lending Templates, it's essential to understand how these types affect your documentation and application process.

Tips to Define Fillable Fields In Electronic Loans Lending Templates For Free

- Identify all the key information needed for the loan application

- Create text boxes and drop-down menus for each piece of information

- Use placeholders or instructions to guide the borrower on what to input

- Consider including checkboxes for the borrower to indicate agreement or understanding

- Ensure all fields are clearly labeled and organized for easy completion

The editing feature for defining fillable fields in electronic loans lending templates may be needed when lenders want to streamline the loan application process and make it more user-friendly for borrowers.

Related Searches

A loan application form is a document used by banks to collect the relevant information from a potential borrower when applying for a loan. A loan agreement is a written agreement between a lender that lends money to a borrower in exchange for repayment plus interest. The borrower will be ... Looking for a loan application form template to use? Use Pandadoc's fully customizable loan application form before signing a contract. A personal loan agreement outlines the terms of how money is borrowed and when it will be paid back. ... 5 Types of Personal Loans; Important Provisions. Fill Personal Financial Statement Template, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ? Instantly. Try Now! Fill Mortgage Statement Template, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ? Instantly. Try Now! In LendingPad, we do not have a template configuration because the template data are either already pre-defined in company level settings or automatically ... The purpose of this form is to collect identifying information about the applicant, loan request, indebtedness, principals of the business, ... This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as ?Borrower? or ... To promptly identify loans with well-defined credit weaknesses so that timely action can be ... a specialized form of lending, and is the primary focus of.

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.