Define Fillable Fields In Electronic Fair Debt Collections Templates For Free

How it works

-

Import your Fair Debt Collections Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Fair Debt Collections Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Define Fillable Fields In Electronic Fair Debt Collections Templates For Free

Web-based PDF editors have demonstrated their dependability and efficiency for executing legal documents. Utilize our safe, quick, and user-friendly service to Define Fillable Areas In Digital Fair Debt Collections Templates At No Cost your files whenever you need them, with minimal effort and utmost precision.

And that’s how you can prepare and share any personal or corporate legal documents in minutes. Give it a try today!

- Upload a document to the editor. You can choose from several options - transfer it from your device or the cloud or retrieve it from a template library, external link, or email attachment.

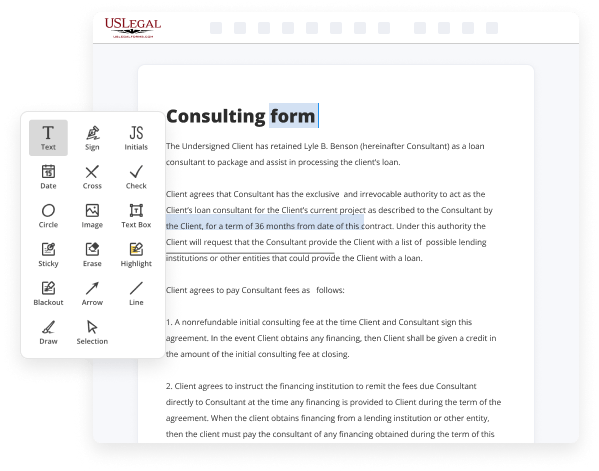

- Complete the vacant fields. Position the cursor on the first blank space and use our editor’s navigation to proceed step-by-step to prevent overlooking any part of your template. Utilize Text, Initials, Cross, and Check tools.

- Make the necessary alterations. Refresh the form with added images, draw lines and signatures, emphasize important elements, or eliminate any unneeded components.

- Create additional fillable sections. Adjust the template with a new area for completion if needed. Use the right-side toolbar for this, placing each field where you anticipate others will input their information, and designate the remaining areas as required, optional, or conditional.

- Arrange your pages. Remove pages you no longer need or produce new ones utilizing the appropriate key, rotate them, or change their sequence.

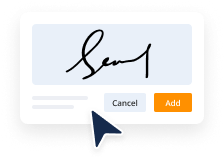

- Produce electronic signatures. Click on the Sign option and choose how you’d incorporate your signature into the form - by typing your name, sketching it, uploading its image, or using a QR code.

- Distribute and send for eSigning. Conclude your editing by clicking the Done button and send your document to other parties for signing via an email request, a Link to Fill option, in an SMS, or fax message. Request a quick online notarization if required.

- Preserve the document in the format you prefer. Download your paperwork, store it in cloud storage in its current format, or convert it as necessary.

Benefits of Editing Fair Debt Collections Forms Online

Top Questions and Answers

The 777 rule refers to a popular guideline among debtors. It suggests that you should respond to debt collectors within seven days, request validation, and stay in communication for seven months to establish a record. Understanding this rule and how to define fillable fields in electronic fair debt collections templates helps you to protect your rights throughout this process. Take advantage of tools like US Legal Forms to prepare your responses effectively.

Tips to Define Fillable Fields In Electronic Fair Debt Collections Templates For Free

- Identify the necessary information that needs to be collected from the debtor

- Consider the format and layout of the template to ensure it is easy to use

- Use dropdown menus or checkboxes for predefined options to streamline data entry

- Include fields for personal information, payment details, and communication preferences

- Ensure the fields are editable to allow for updates and changes as needed

It is important to define fillable fields in electronic Fair Debt Collections templates to efficiently collect debtor information. This can make the process streamlined for both the collector and debtor. The editing feature for defining fillable fields in electronic Fair Debt Collections templates may be needed when there are updates in the debtor's information or changes in payment terms.

Related Searches

Debt Collection model forms and samples. Download English and translated versions of Debt Collection Rule model form. Editable versions of the forms are ... Section 1006.6(b)(1)(i) prohibits a debt collector from communicating or attempting to communicate, including through electronic communication media, at any ... This part carries out the purposes of the FDCPA, which include eliminating abusive ... of this section may be displayed electronically as a fillable field. Complete Fdcpa Pdf Form online with US Legal Forms. Easily fill out PDF blank, edit, and sign them. Save or instantly send your ready documents. Under the FDCPA and Regulation F, a ?debt collector? is defined as: ? Any person7 who uses any instrumentality of interstate commerce or mail in any business. A comprehensive guide providing what you need to know about pre-built templates or creating new agreement form templates and contract ... The final rule is based primarily on the Bureau's authority to issue rules to implement the FDCPA and, consequently, covers debt collectors, as ... The CFPB considered amending the definition of a debt collector under the FDCPA ? including changing the definition to include an entity ... The Bureau proposes to amend Regulation F, which implements the FDCPA, to require debt collectors, as that term is defined in the FDCPA, ... (a) It is unlawful to design, compile, and furnish any form knowing that such form would be used to create the false belief in a consumer that a person other ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.