Annotate Online EIN Services Templates For Free

How it works

-

Import your EIN Services Forms from your device or the cloud, or use other available upload options.

-

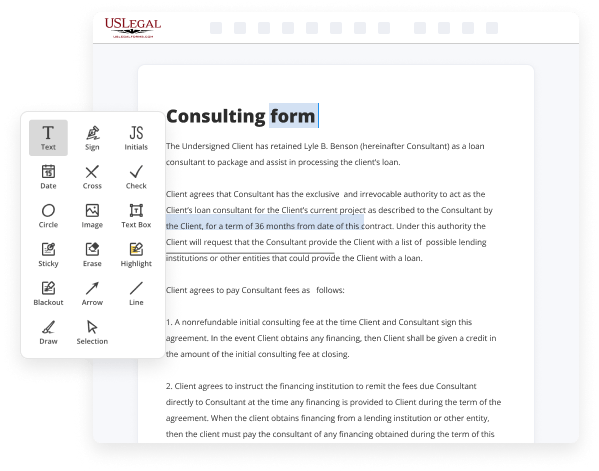

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

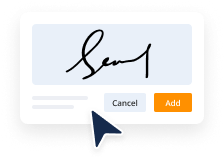

Sign your EIN Services Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Annotate Online EIN Services Templates For Free

Are you fatigued by incessant document printing, scanning, mailing, and squandering valuable time and resources with manual completion? The era has progressed, and the simplest way to Annotate Online EIN Services Templates For Free and make any other vital modifications to your forms is by managing them online. Choose our swift and dependable online editor to finalize, alter, and execute your legal documentation with utmost efficiency.

Emphasize the key points with the Highlight option and remove or redact fields containing no information. Adjust and rearrange the form. Utilize our upper and side toolbars to modify your content, add extra fillable fields for different data types, reorganize sheets, include new ones, or eliminate unnecessary ones. Sign and obtain signatures. Regardless of the method you choose, your eSignature will be legally binding and admissible in court. Dispatch your form to others for approval via email or signing links. Notarize the documents directly in our editor if it requires witnessing. Share and store the copy. Download or export your completed documents to the cloud in your desired format, print it out if you wish for a physical copy, and select the most convenient file-sharing method (email, fax, SMS, or via traditional mail using the USPS). With our service, there are no longer any excuses to manually prepare legal documents. Save time and effort by executing them online twice as fast and more accurately. Give it a try now!

- Upload or import a document to the editor.

- Drag and drop the template into the upload area, import it from cloud storage, or use an alternative method (extensive PDF catalog, emails, URLs, or direct form requests).

- Provide the necessary information.

- Fill in blank fields using the Text, Check, and Cross tools from our upper pane.

- Utilize our editor’s navigation to ensure you’ve filled everything out.

Benefits of Editing EIN Services Forms Online

Top Questions and Answers

To obtain an Individual Taxpayer Identification Number (ITIN), you must complete Form W-7 and meet certain eligibility criteria such as being a non-resident alien. You’ll also need to provide a valid reason for applying, like filing your tax return. Don't forget, using Annotate Online EIN Services Templates can assist you in compiling the necessary documentation for this process.

Related Features

Tips to Annotate Online EIN Services Templates For Free

- Use highlighting to emphasize important information

- Add comments to clarify or provide additional details

- Include hyperlinks to related documents or resources

- Use different colors to categorize different types of information

- Use the strike-through feature to mark outdated or incorrect information

The editing feature for Annotate Online EIN Services Templates may be needed when you want to customize a template for specific business needs, collaborate with others on a document, or add additional information for reference purposes.

Related Searches

Fill Ein Confirmation Letter Pdf, Edit online. Sign, fax and printable from PC, iPad, tablet or mobile with pdfFiller ? Instantly. Try Now! The first two digits (the EIN Prefix) are determined by the Campus of Record assigning the EIN, unless the taxpayer is applying using the online EIN application ... Responsible Parties. All EIN applications (mail, fax, electronic) must disclose the name and Taxpayer Identification Number (SSN, ITIN, or EIN) ... If you are unfamiliar with the online Employer Identification Number (EIN) application process, review these questions and answers. You may apply for an EIN in various ways, and now you may apply online. This is a free service offered by the Internal Revenue Service. This page will show you how to get an EIN (Federal Tax ID Number) for LLC online. It takes 15 minutes. The IRS gives out EINs for free. An Employer Identification Number (EIN) is a unique number assigned to a business for easy IRS identification for tax reporting purposes. An EIN is an ID assigned to your business that the IRS can use for tax ... Revenue Service) can easily identify business entities for tax reporting. The simplest way to apply for your EIN is online via the IRS EIN Assistant . As soon as your application is complete and validated, you'll be ... Apply online at Apply for an Employer Identification Number (EIN) Online. ... Tax ID number with the Minnesota Department of Revenue online at Business ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.