Add Formula Field To Legal Massachusetts Startup For S-Corporation Forms For Free

How it works

-

Import your Massachusetts Startup For S-Corporation Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

Sign your Massachusetts Startup For S-Corporation Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Formula Field To Legal Massachusetts Startup For S-Corporation Forms For Free

Online PDF editors have demonstrated their reliability and efficiency for legal paperwork execution. Use our secure, fast, and user-friendly service to Add Formula Field To Legal Massachusetts Startup For S-Corporation Forms For Free your documents any time you need them, with minimum effort and highest accuracy.

Make these quick steps to Add Formula Field To Legal Massachusetts Startup For S-Corporation Forms For Free online:

- Import a file to the editor. You can choose from several options - add it from your device or the cloud or import it from a form catalog, external URL, or email attachment.

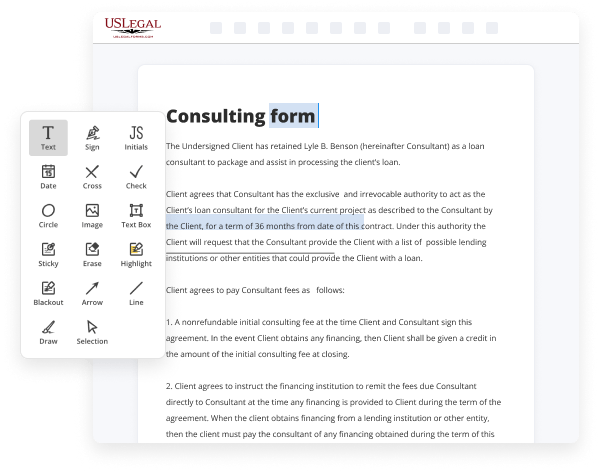

- Fill out the blank fields. Place the cursor on the first empty area and use our editor’s navigation to move step-by-step to prevent missing anything on your template. Use Text, Initials, Cross, and Check tools.

- Make your necessary edits. Update the form with inserted pictures, draw lines and icons, highlight significant parts, or remove any unnecessary ones.

- Drop more fillable fields. Modify the template with a new area for fill-out if neccessary. Use the right-side toolbar for this, drop each field where you expect other participants to provide their data, and make the remaining areas required, optional, or conditional.

- Arrange your pages. Delete sheets you don’t need anymore or create new ones making use of the appropriate key, rotate them, or change their order.

- Create electronic signatures. Click on the Sign tool and choose how you’d add your signature to the form - by typing your name, drawing it, uploading its picture, or utilizing a QR code.

- Share and send for eSigning. End your editing with the Done button and send your copy to other parties for signing through an email request, with a Link to Fill option, in an SMS or fax message. Request a prompt online notarization if needed.

- Save the file in the format you need. Download your document, save it to cloud storage in its current format, or convert it as you need.

And that’s how you can prepare and share any personal or business legal paperwork in minutes. Try it now!

Benefits of Editing Massachusetts Startup For S-Corporation Forms Online

Top Questions and Answers

The minimum tax is $456. Taxable Period: The taxable period for corporations is either the calendar year or the corporation's fiscal year. Estimated payments are made every three months during the taxable year. Federal accounting periods and methods have been adopted.

Tips to Add Formula Field To Legal Massachusetts Startup For S-Corporation Forms For Free

- Identify the data fields you want to incorporate into the formula

- Understand the calculations and logic required for the formula

- Access the platform or software where you can add formula fields to S-Corporation forms

- Input the formula using the designated syntax or formula builder tool

- Test the formula field to ensure accurate calculations

- Save the formula field for future use

Adding formula fields to legal Massachusetts startup S-Corporation forms can be a useful tool for automating calculations such as tax liabilities, revenue projections, or employee benefits. It may be needed when dealing with complex financial data that requires immediate and accurate computations.

Related Searches

Here are the steps you should take to Add Required Fields To Legal Massachusetts Startup For S-Corporation Forms quickly and effortlessly: Upload or import a ... Learn which taxpayers are eligible and ineligible to own shares in an S corporation. Filing requirement and Financial Institution ... DOR has released its 2022 MA Corporate Excise tax forms. The forms are subject to change only by federal or state legislative action. All federal S corporations subject to California laws must file Form 100S and pay the greater of the minimum franchise tax or the 1.5% income or franchise tax. 2022. Instructions for Form 1120-S. U.S. Income Tax Return for an S Corporation. Department of the Treasury. Internal Revenue Service. If the S corporation election was terminated during the tax year and the corporation reverts to a C corporation, file Form 1120-S for the S ... An S Corp owner has to receive what the IRS deems a ?reasonable salary? ... earning enough yet to pay yourself a salary comparable to others in your field. To report your New York additions from a partnership, New York S corporation, or estate or trust, complete Schedule A, Part 2. Form an S Corp today providing limited liability protection to owners, offering special IRS tax status and more. Let BizFilings help you start an S corp. S corporations provide a Schedule K-1 that reports each shareholder's share of income, losses, deductions, and credits that are reported to the ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.