Add Date To Online EIN Services Templates For Free

How it works

-

Import your EIN Services Forms from your device or the cloud, or use other available upload options.

-

Make all necessary changes in your paperwork — add text, checks or cross marks, images, drawings, and more.

-

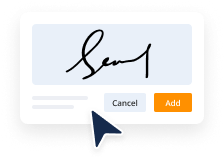

Sign your EIN Services Forms with a legally-binding electronic signature within clicks.

-

Download your completed work, export it to the cloud, print it out, or share it with others using any available methods.

How to Add Date To Online EIN Services Templates For Free

Legal paperwork demands utmost accuracy and prompt execution. Although printing and completing forms often consumes substantial time, online document editors demonstrate their utility and efficiency. Our platform is available if you seek a reliable and user-friendly tool to Add Date To Online EIN Services Templates For Free swiftly and securely. Once you experience it, you will be astonished at how effortless managing formal documentation can be.

Press Done when you are prepared and choose where to store your form - download it to your device or export it to the cloud in any file format you desire. Share a copy with others or send it to them for their approval via email, a signing link, SMS, or fax. Request online notarization and receive your form promptly witnessed. Envision executing all the above manually in writing when even a single mistake obliges you to reprint and re-enter all the information from scratch! With online services like ours, the process becomes significantly more manageable. Test it now!

- Upload your template through one of the provided methods - from your device, cloud storage, or PDF library.

- You may also retrieve it from an email, direct URL, or via a request from another individual.

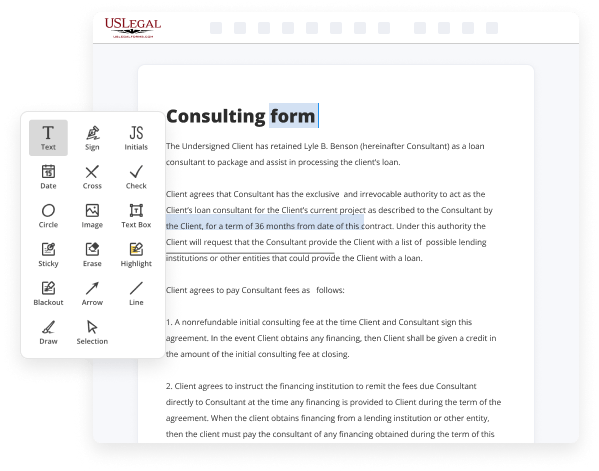

- Utilize the top toolbar to complete your document: commence typing in text fields and click on the box fields to select suitable options.

- Make additional crucial modifications: insert images, lines, or symbols, emphasize or erase certain details, and so on.

- Employ our side tools to arrange pages - add new sheets, change their sequence, remove unnecessary pages, include page numbers if they are absent, and so forth.

- Incorporate extra fields into your document requesting various types of information and apply watermarks to safeguard the contents from unauthorized duplication.

- Verify that all information is accurate and sign your documents - create a legally-valid eSignature in your chosen manner and insert the current date next to it.

Benefits of Editing EIN Services Forms Online

Top Questions and Answers

Tax ID numbers, including EINs, generally follow the pattern of nine digits, often represented as XX-XXXXXXX. This consistent format allows various institutions to easily process tax-related matters. Be mindful of this format when you add date to online EIN services templates, to maintain uniformity in your documents.

Related Features

Tips to Add Date To Online EIN Services Templates For Free

- Ensure that the date format matches the requirements of the specific EIN service template

- Use a reliable calendar tool to select the date accurately

- Double-check the date before submitting the template to avoid errors

- Consider including a note or label next to the date field for clarification

Editing the date on an online EIN services template may be necessary when updating company information, renewing licenses, or applying for new permits. It is important to input the correct date to ensure the accuracy of the documents being submitted.

Related Searches

If you are unfamiliar with the online Employer Identification Number (EIN) application process, review these questions and answers. Purpose of Form. Use Form SS-4 to apply for an EIN. An EIN is a 9-digit number (for example, 12-3456789) assigned to sole proprietors, ... Use the IRS tax calendar to view filing deadlines and actions each month. Access the calendar online from your mobile device or desktop. An Employer Identification Number (EIN) is a nine-digit number that IRS assigns in the following format: XX-XXXXXXX. It is used to identify the tax accounts ... The first two digits (the EIN Prefix) are determined by the Campus of Record assigning the EIN, unless the taxpayer is applying using the online EIN application ... If you apply by mail, send your completed Form SS-4PDF at least four to five weeks before you need your EIN to file a return or make a deposit. Browse the self-service tax tools for individual taxpayers, businesses and tax professionals. Type or print clearly. 1 Legal name of entity (or individual) for whom the EIN is being requested. 2 Trade name of business (if different ... Find out how to close your employer identification number (EIN) account. The SSA provides two free e-filing options on its Business Services Online (BSO) website. ? W-2 Online. Use fill-in forms to create, save, print, and submit ...

Industry-leading security and compliance

-

In businnes since 1997Over 25 years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.

-

VeriSign secured#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.